Disclosure: The Globetrotting Teacher may receive commission from card issuers. Some or all of the card offers that appear on the The Globetrotting Teacher are from advertisers & may impact how & where cards appear on the site. The Globetrotting Teacher does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Do you earn Chase Ultimate Rewards points?

There’s a ton of value to these flexible points. But it’s important to understand a few basics as an Ultimate Rewards-earning cardholder.

In this guide, let’s talk about what you need to know about the Ultimate Rewards Program so you can leverage the possibilities that come with your account.

What You Need to Know About

Chase Ultimate Rewards Points

Chase Ultimate Rewards points are a flexible, transferable points currency earned by using Chase Ultimate Rewards points-earning credit cards.

These points are not connected to one particular airline or hotel loyalty program.

Ultimate Rewards points are extremely valuable because they can be used for a variety of airline and hotel travel rewards with the transfer partners.

This is similar to Amex Membership Rewards points, Citi ThankYou points, Marriott Bonvoy points, and Capital One miles who all have their own set of travel transfer partners where their flexible points currencies can be used for award flights and nights.

Estimates value Chase Ultimate Rewards points around 2 cents per point. But, these versatile travel rewards points can return an even higher value when used the right way.

Travel hacking beginners, especially, just can’t have too many Ultimate Rewards points. And luckily, they’re relatively easy to learn how to use.

Getting Started with Chase’s Travel Rewards Credit Cards

The quickest, but certainly not the only, way to accumulate a large amount of Chase Ultimate Rewards points is through credit cards with attractive welcome bonuses.

But, it’s important to understand Chase’s credit card application rules and restrictions, as well as the differences in the travel rewards cards they offer.

Most importantly, especially for miles and points beginners, is Chase’s 5/24 rule.

The rule says Chase will deny you for their travel rewards credit cards if you have 5 or more new credit cards from ANY bank in the last 24 months.

The most common mix-up is the difference between your 5/24 “count” and which cards are “subject to” 5/24.

Let me explain the difference.

All Chase travel rewards cards are subject to 5/24. This means Chase will look at whether or not you’ve opened 5 or more credit cards in the last 24 months to determine approval regardless of how amazing your credit score is.

All Chase Ultimate Rewards-earnings cards in the Sapphire, Freedom, and Ink families are subject to the rule. All of Chase’s co-branded credit cards are also subject to 5/24.

This also includes airline credit cards like the British Airways Visa Signature, Southwest Rapid Rewards Premier, and the United Explorer Card, as well as hotel credit cards like the Hyatt and IHG cards Chase offers.

So, if you’re someone who has opened 5 or more credit cards in the last 24 months from ANY bank and you apply for a Chase travel rewards credit card, you will be denied no matter how stellar your financial history is.

In addition, all credit cards, except for most business credit cards, will add to your overall 5/24 count.

Let’s say you’ve applied for 2 personal credit cards from ANY bank in the last 24 months. Chase will see you as 2/24.

Then, you decide to apply for (another) Chase personal credit card, like The World of Hyatt Credit Card. Assuming all is good to excellent with your credit and financials, you’d be approved.

Chase will consider their 5/24 rule in approving you and you’ll now be considered 3/24, assuming you’re approved. You’d have 1 less “slot” for valuable Chase travel rewards credit cards.

Therefore, when starting out with travel rewards credit cards, it’s important to choose which Chase cards will help you with your long-term travel goals.

Likewise, it isn’t a good strategy to start with credit cards from other banks, as you’ll lose valuable slots for Chase credit cards.

However, let’s say you’re someone who’s 4/24 and applies for the Chase Business Ink Preferred.

Your application will be subject to 5/24 which would get the all-clear at 4/24. But because it’s a business card, the Chase Ink Preferred won’t add to your 5/24 count.

After being approved, Chase will still think of you as 4/24.

Typically, Chase can see that you have business credit cards with them, but won’t count them towards your 5/24 status. Business cards from other banks also don’t add to your 5/24 count.

Are all Ultimate Rewards points created equally?

No. So, let’s be clear.

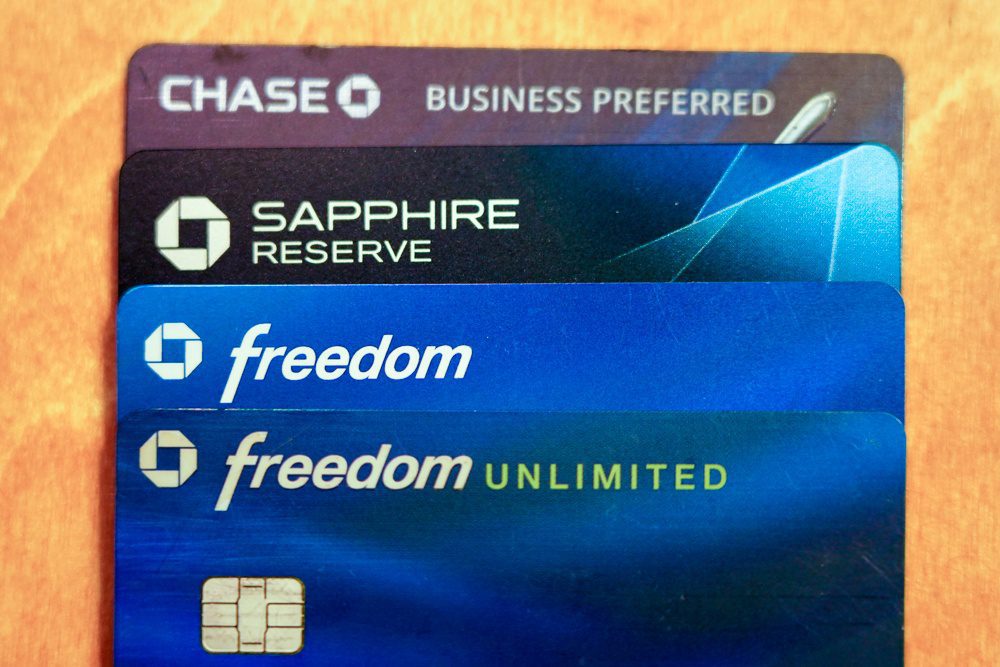

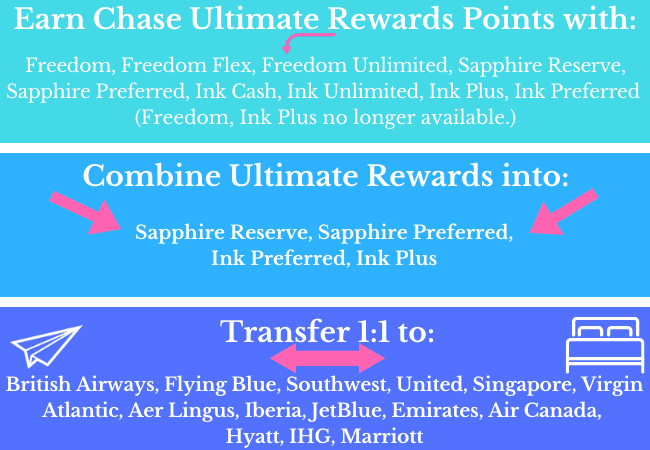

There are several credit cards that earn Chase Ultimate Rewards points.

- Some of them earn Ultimate Rewards points that CAN be transferred to any of Chase’s airline and hotel transfer partners, as well as can be used in the Chase travel portal for a 1.25-1.5 cents per point value.

These cards include the:

- Chase Sapphire Reserve,

- Chase Sapphire Preferred,

- Chase Ink Business Preferred, and,

- Ink Business Plus (no longer available, existing cardholders only).

- While other cards earn Ultimate Rewards points that can be redeemed as cash back rewards or in the Chase travel portal for a fixed value of 1 cent per point.

- On their own, these UR points CAN’T be transferred to any of Chase’s airline or hotel transfer partners.

These cards include the:

- Chase Freedom Flex,

- Chase Freedom Unlimited,

- Chase Freedom (no longer available)

- Chase Ink Business Cash, and

- Chase Ink Business Unlimited.

For the purposes of building an effective Ultimate Rewards earning strategy, you need to pair the Freedom family of cards, as well as the Ink Cash and Ink Unlimited, with a Sapphire Preferred, a Sapphire Reserve, or an Ink Preferred.

When they are paired with one of these cards, the Ultimate Rewards points earned can be combined with your Sapphire and/or Ink Preferred points balances.

Once combined, all of these Ultimate Rewards points will have access to Chase’s airline and hotel transfer partners, therefore increasing the value of your points.

How to Combine Ultimate Rewards Points

It’s so important to know how to combine Ultimate Rewards points and to do it often.

From time to time, rumors have swirled about Chase restricting the ability to merge points. The lesson here is it’s better to be safe, combine your points frequently so as not to get stuck with points stranded with cards that don’t have the ability to access the Chase transfer partners.

Here’s what you need to know about Chase’s rules for combining points.

With personal Ultimate Rewards credit cards, Chase says,

“You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household.”

With business Ulitmate Rewards credit cards, Chase says,

“You can move your points, but only to another Chase card with Ultimate Rewards belonging to you or your joint business owner, as applicable.”

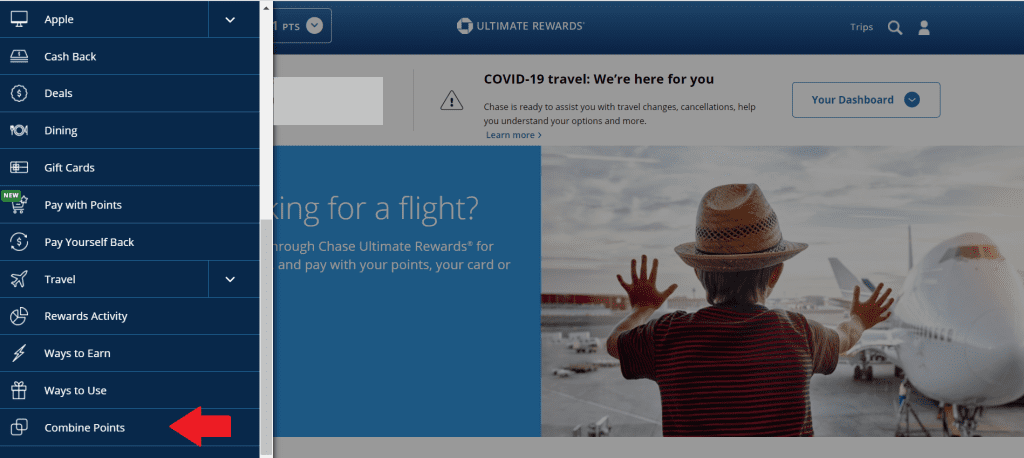

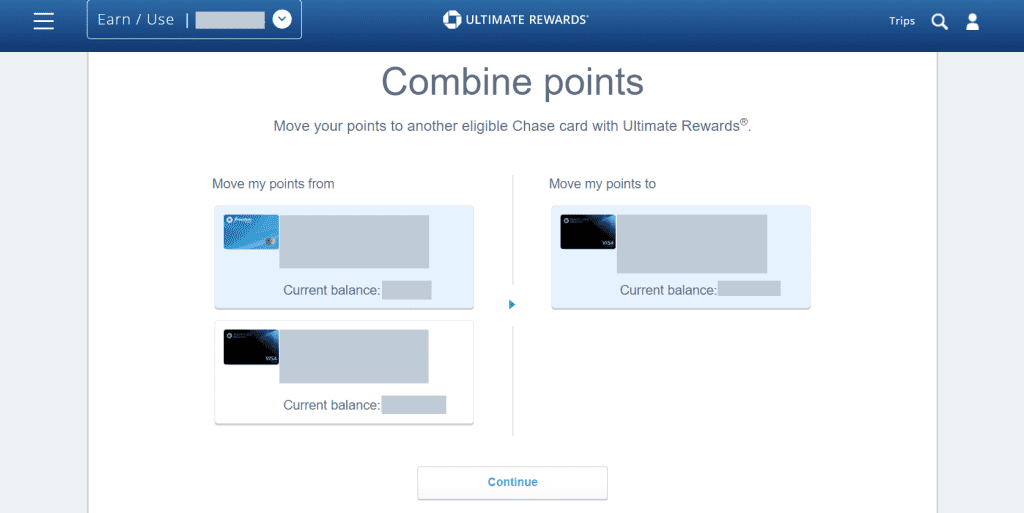

It’s super simple to combine Ultimate Rewards points. Follow along with these account screenshots.

From your Ultimate Rewards dashboard, click on the dropdown menu on the top left of the screen. Scroll down the menu until you reach “Combine Points.”

You’ll arrive at a series of screens where you’ll be asked which points you’d like to combine, where you’d like them to go, and how many you’d like to combine.

You’ll select which Ultimate Rewards earning credit card to move the points from and which credit card to move your points to.

If you need to combine your Ultimate Rewards points into a household member’s Ultimate Rewards account, you’ll now need to call or secure message Chase to do this. It’s simple enough for the agents but it does require that you reach out to Chase.

If you and a household member have combined Ultimate Rewards points in the post, you’ll see this person’s name and account at the bottom of the “Move my points to” column.

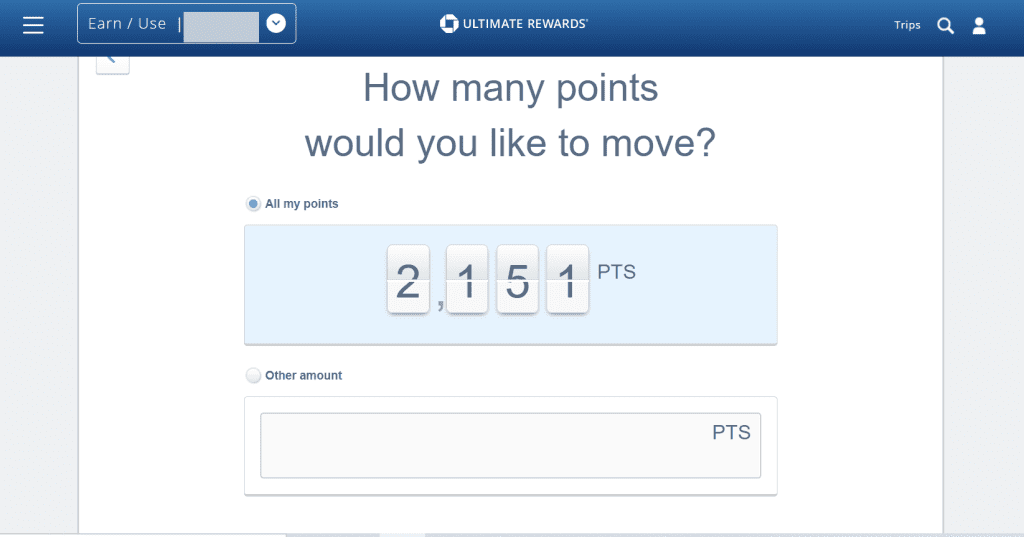

After continuing to the next screen, you’ll be asked how many UR points you’d like to combine. Select all your points or type in a specific amount. Typically I combine all my Ultimate Rewards connected to my Freedom Flex and move them to my Chase Sapphire Reserve.

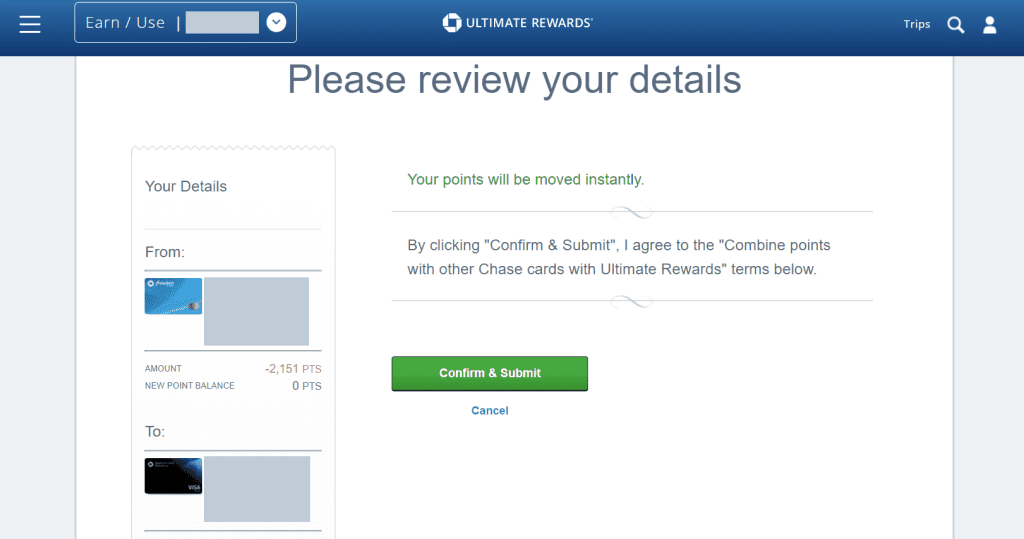

You’ll be prompted to review and confirm. Once you do, voila! Your Ultimate Rewards points are combined with the account you selected.

How to Transfer Ultimate Rewards Points to a Transfer Partner

Knowing how to transfer your UR points to one of those airline and hotel transfer partners I keep talking about is the way you’ll eventually get the most value from your Ultimate Rewards points.

You don’t need to know how to make use of all of them right now. Just learning who these transfer partners are and the process for transferring to them is a great place to start.

You can also check out this list of things you need to know before you transfer any points.

Here are some basics to know about Chase’s transfer partners.

Chase’s airline transfer partners are:

- United

- Air Canada Aeroplan

- Southwest

- Singapore Airlines

- British Airways

- Air France-KLM/Flying Blue

- JetBlue

- Virgin Atlantic

- Aer Lingus

- Iberia

- Emirates

Chase’s hotel transfer partners are:

- IHG

- Marriott

- Hyatt

You should also understand:

- Ultimate Rewards points transferred to any of these partners must be done so in 1,000-point increments.

- All transfers are 1:1, meaning 1,000 UR points equals 1,000 points in the program to where you moved the points.

- All transfers are final, so look at all the details before submitting a transfer request and be sure the award space you want is available!

- Most points transfer instantly. But, Singapore Airlines can take 1-2 business days.

- You can transfer UR points to your own airline and hotel loyalty accounts.

- But, to transfer Ultimate Rewards points to another person’s airline or hotel loyalty account, she/he must live in the household (i.e. spouse or domestic partner) AND be an authorized user on the card. This last requirement is not the case when just combining UR points.

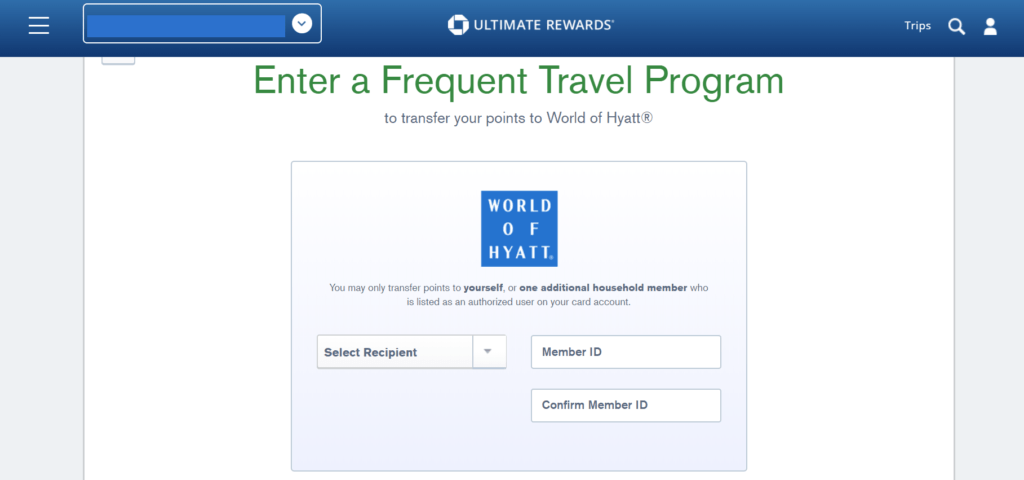

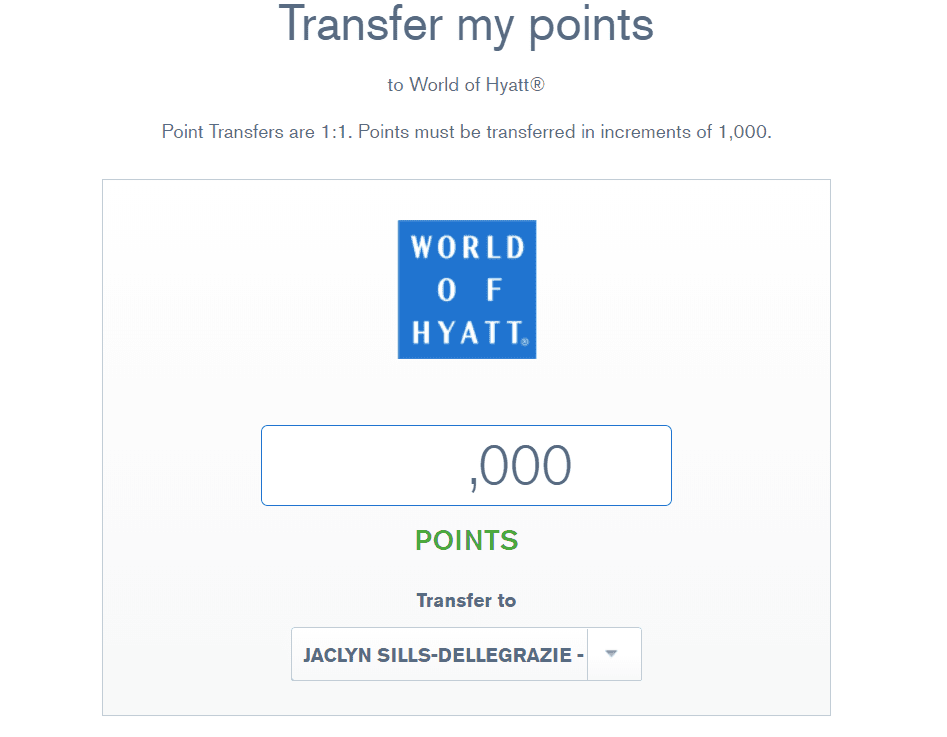

Follow these tutorial screenshots to see how to transfer Ultimate Rewards points to an airline or hotel partner. You’ll notice that Hyatt is one of my favorite Ultimate Rewards transfer partners.

From the same dropdown menu where “Combine Points” is, look for the option that says, “Transfer to Travel Partners.”

You’ll arrive at a screen listing the airline and hotel transfer partners. Select which one you’d like to transfer your Ultimate Rewards points to.

Then, enter the requested member name and member ID information for that loyalty program. In this example, you’d need to enter your Hyatt number.

Note the specific information telling you whose loyalty account you can transfer Ultimate Rewards points into.

After that, continue to the next screen where you’re prompted to enter the number of Ultimate Rewards points you’d like transferred.

Remember, points transfers can’t be undone. Make sure the details are correct and you’ve already checked for the award availability you need.

If everything looks good, submit the transfer request and wait for the transfer confirmation screen.

Why are these airline and hotel transfer partners so valuable?

There’s a lot to unpack with that, but quite simply, it gives you the ability to redeem travel rewards and have a much wider array of flight and hotel night possibilities.

The next post in this series will go into greater detail about how to best use Ultimate Rewards transfer partners.

Having options means being able to choose the best value for your travel plans and (likely) a greater degree of award availability than points and miles that are limited in their use or just for a specific airline or hotel.

Travel Portal ≠ Transfer to Travel Partners

To clarify, Chase also has a travel portal you can access from within your Ultimate Rewards dashboard. This is DIFFERENT from transferring Ultimate Rewards points to an airline or hotel transfer partner.

There are times when it might not make sense to transfer Ultimate Rewards points to a partner, but instead, to use them in the Chase travel portal. This may be the case for super cheap airfare deals, for example, or for times when you don’t have flexibility with award program availability.

For now, though it’s important to know where to find the travel portal and how to book award travel this way, as well as to realize it’s not the same thing as transferring to one of Chase’s airline or hotel transfer partners.

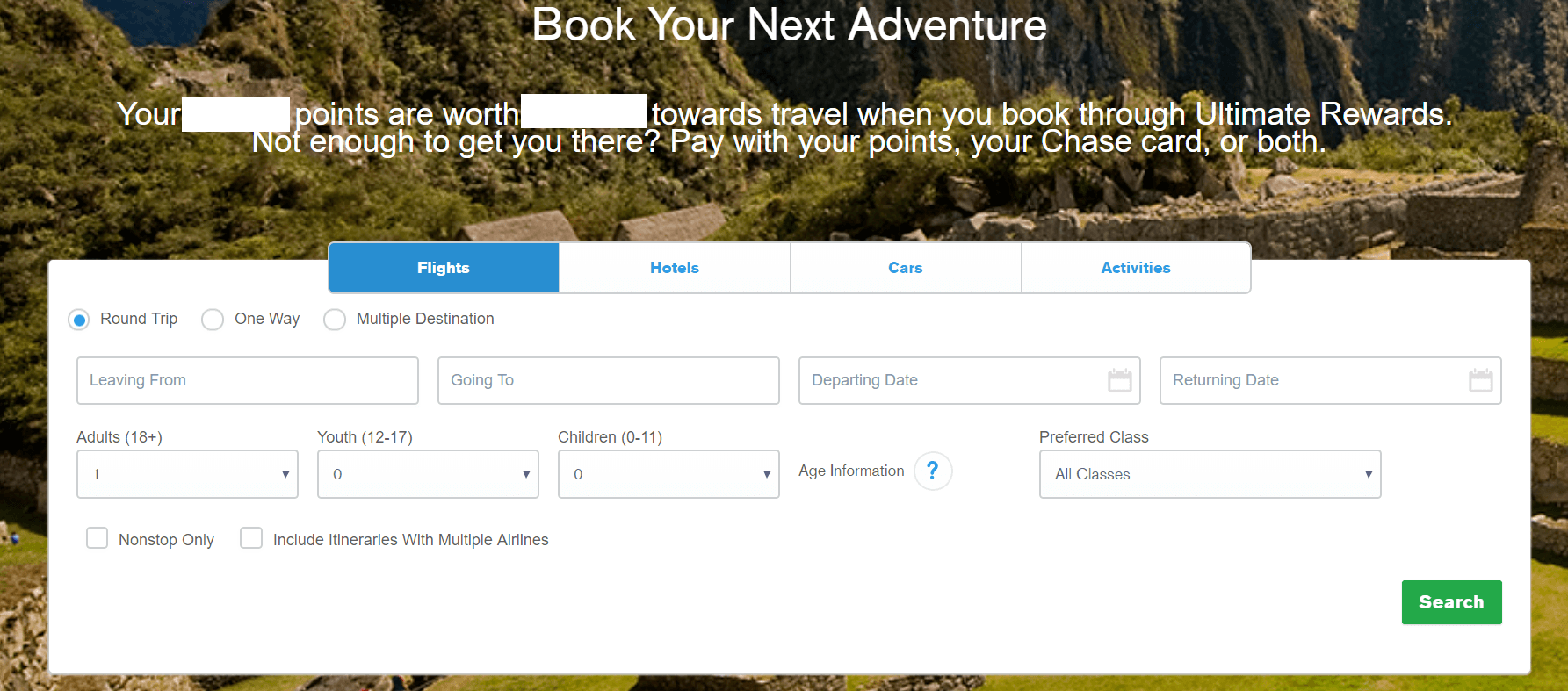

Here are a few quick screenshots to show you.

From the same dropdown menu on the top left side, look for the “Travel” option.

From here, you can search for flights, hotels, cars, and activities. The results will show the dollar amount and the number of UR points you’d need to book that travel.

You have the option to pay, use Ultimate Rewards points, or select a combination of cash and points.

If you have a Chase Sapphire Reserve, it’s best to book travel through this account because of the 50% bonus that comes with this card compared to other Ultimate Rewards earning cards.

Your Ultimate Rewards points are worth more with a Sapphire Reserve than they are with a Sapphire Preferred or the business card Ink Preferred.

The biggest perk to booking within the travel portal, aside from maybe finding a cheap flight deal, is earning airline miles for your flight.

For example, if you book a flight with Delta through the Chase travel portal, the airline will see your ticket as being paid with “cash.” You’ll earn Delta miles for a flight you actually paid for with Ultimate Rewards points.

On the contrary, beware that hotel bookings through the Chase portal don’t come with any elite hotel benefits you might already have through a hotel loyalty program.

If you have status with Hyatt, for instance, Hyatt wouldn’t honor your status benefits because you booked through a third-party website.

Use Chase Ultimate Rewards to Earn Points

The goal of this guide has been to help you understand how to use your Ultimate Rewards account effectively.

Up until now, we’ve focused on features that handle points management and the process for how to use them.

However, you can also keep growing your Ultimate Rewards points balance by using the Chase Ultimate Rewards Shopping Portal.

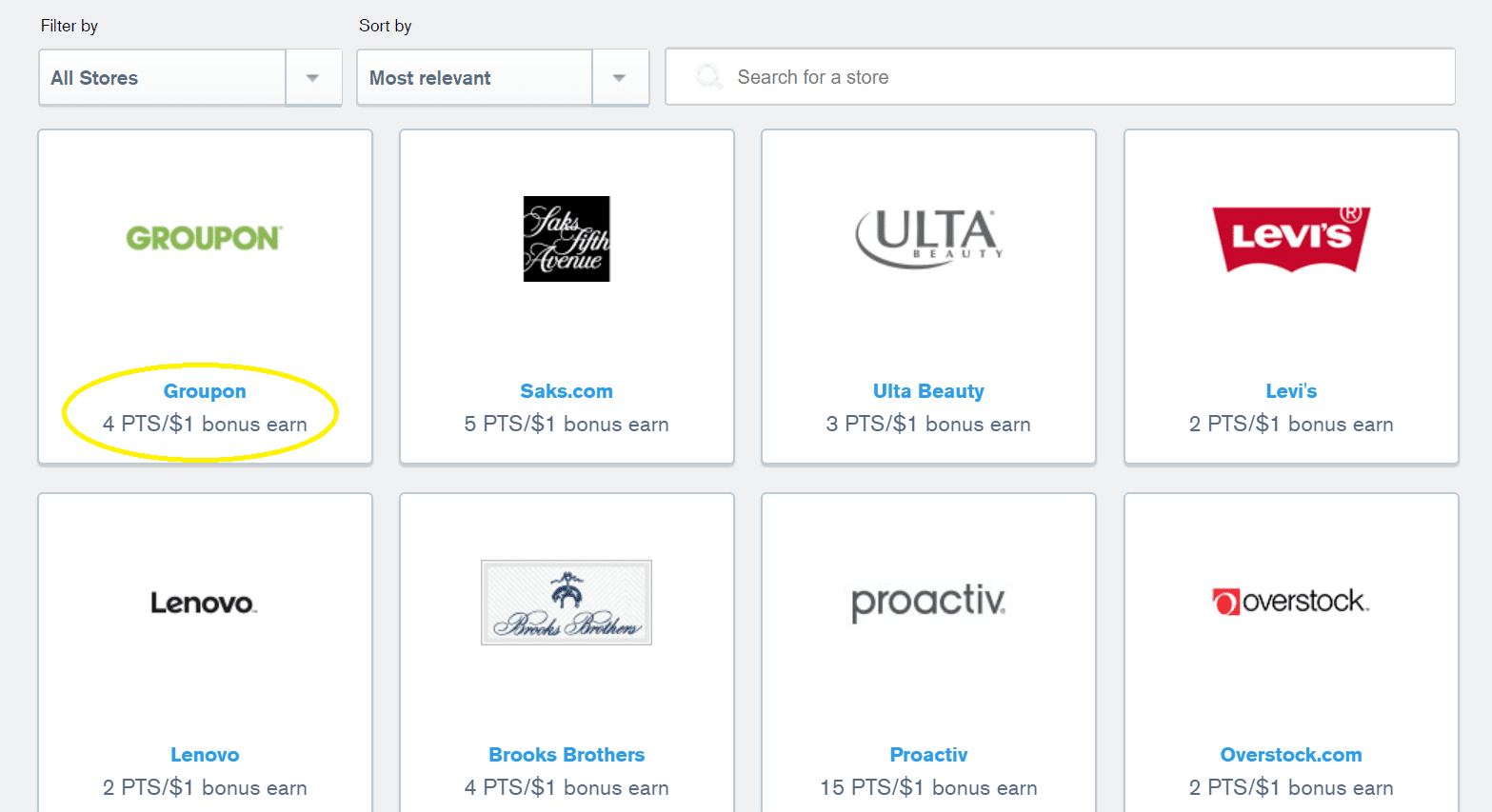

Once again from your top left dropdown menus, look for the option to “Earn Bonus Points.”

From here, you can access hundreds of merchants where you likely already shop and earn additional Ultimate Rewards points for purchases you were going to make anyway.

You’ll be able to see featured merchants, all stores, or search for a particular merchant by typing it in the search field.

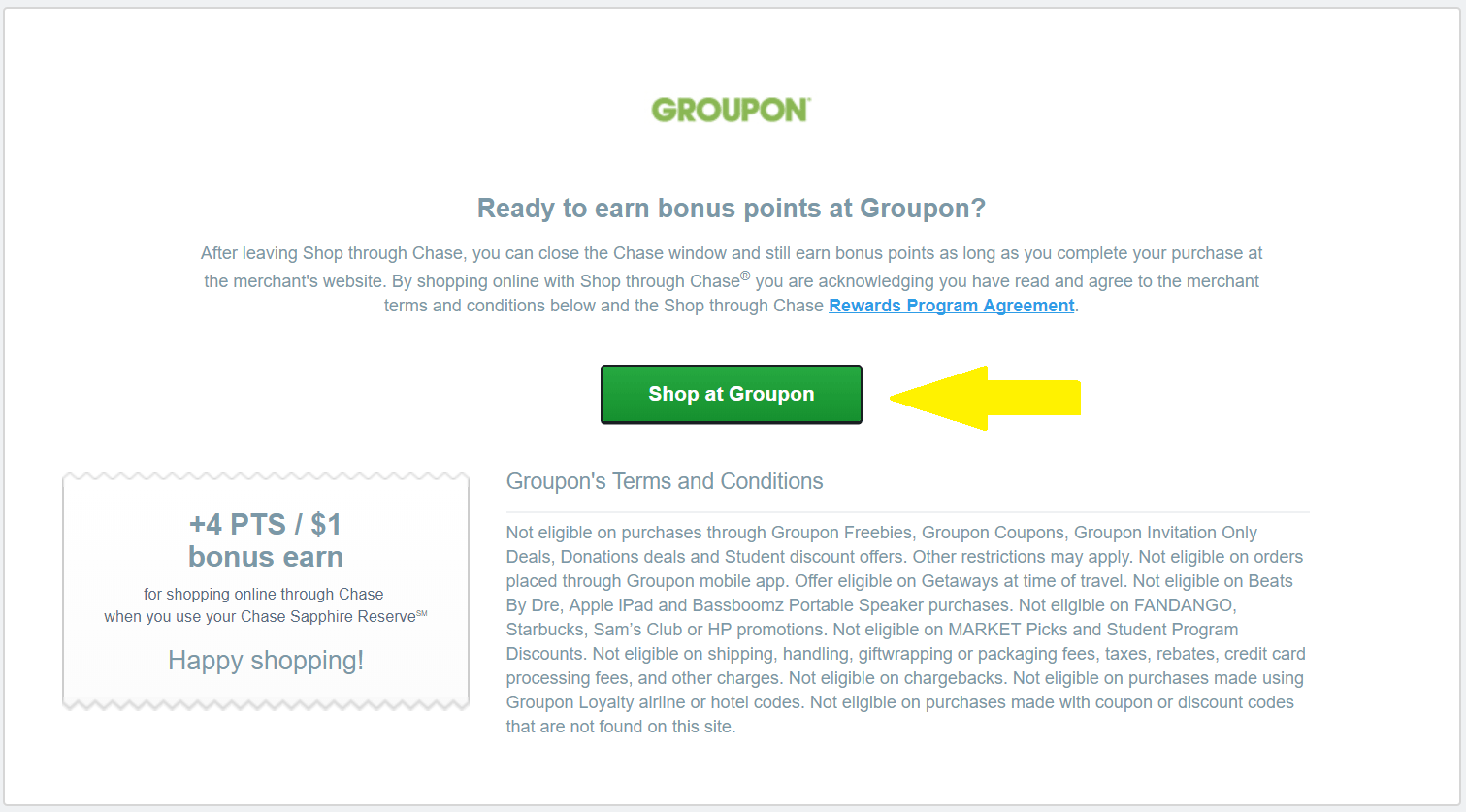

As you can see above, for example, shopping at Groupon will earn 4 Ultimate Rewards points per $1 spent. This is in addition to the 1 Ultimate Reward point per $1 you’ll earn for using your Ultimate Rewards credit card.

Once you find the merchant where you’d like to shop, click on it and then confirm by clicking on the green “Shop at..” button.

You’ll be redirected to Groupon and you can shop normally. Just be sure to pay with an Ultimate Rewards-earning card to earn the shopping portal bonus.

ProTip: Shopping portals are great ways to earn tons of miles and points for your everyday purchases. Many airline and hotel programs have them, in addition to Chase Ultimate Rewards.

The bottom line is:

Chase Ultimate Rewards points are valuable travel rewards points. Understanding the basics and how to use your Ultimate Rewards credit cards and account effectively is one of the important keys to your success.

Now that you know these fundamentals, you’re better positioned to take full advantage of your Ultimate Rewards account and maximize your Ultimate Rewards points for award nights and flights!

What are your questions about Chase Ultimate Rewards?

Like this post? Please share it on social media using the share button below.