Disclosure: The Globetrotting Teacher may receive commission from card issuers. Some or all of the card offers that appear on the The Globetrotting Teacher are from advertisers & may impact how & where cards appear on the site. The Globetrotting Teacher does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Ultimate Rewards points are a flexible, transferable points currency earned by using Chase Ultimate Rewards points-earning credit cards like the Chase Sapphire Reserve® or the Ink Business Preferred® Credit Card.

These points are not connected to a particular airline or hotel loyalty program but rather can be redeemed on any of the Chase Ultimate Rewards transfer partners.

The number of travel reward possibilities as a result of these partnerships makes Ultimate Rewards points especially valuable.

In Part 1 of this series, I discussed the fundamentals of Chase Ultimate Rewards points, as well as how to use your Ultimate Rewards account effectively.

In this guide, you’ll get an overview of each of the Chase Ultimate Rewards airline and hotel transfer partners to help you know where your Ultimate Rewards points might be best used.

If you’re feeling overwhelmed by how much there is to learn, you’re not alone. Start with a few transfer partners and learn little by little how they can help you reach your travel goals.

What You Need to Know About

Chase Ultimate Rewards: Transfer Partners

Generally speaking, transferring Ultimate Rewards points to a travel partner returns the best value for your Ultimate Rewards points. However, not all transfer partners are equally as valuable so it’s important to understand the differences.

In the miles and points community, there’s always discussion about redeeming miles and points for the highest per-point value. Obviously, this makes sense.

You want to squeeze every last drop of value from your Ultimate Rewards points.

Just also keep in mind that value can also be relative.

If your Ultimate Rewards points help you take a trip you otherwise couldn’t afford to take, the per-point mathematical calculations become less important.

Personally, I always try to get the best return on Ultimate Rewards points, but I also don’t have the disposable income to travel all the time so it’s a balance of these 2 factors that I consider when planning how to best use my miles and points.

Lastly, one of the biggest transferrable points mistakes is to move your points to an airline or hotel before checking the available award space.

Never transfer Ultimate Rewards points (or any flexible currency points!) to an airline or hotel until you’re sure the award space you want is available. Points transfers are irreversible.

ProTip: You can read my Sapphire Reserve and Chase Sapphire Preferred® Card reviews here for a fuller look at the differences between each card.

Chase Ultimate Rewards Airline Partners

These are Chase’s airline transfer partners.

- United,

- Aeroplan Air Canada,

- Southwest,

- Singapore Airlines,

- JetBlue,

- KLM/Flying Blue,

- Virgin Atlantic,

- British Airways,

- Aer Lingus,

- Iberia, and,

- Emirates

Your Chase Ultimate Rewards points will transfer 1:1 to all of these airline partners. So, 5k Ultimate Rewards points equal 5k miles or points in the airline partner to which you transfer your points.

Let’s look at each airline partner individually.

United

United is most certainly one of the most popular Ultimate Rewards transfer partners. The airline is a member of the Star Alliance along with many other airlines including Swiss Air, Lufthansa, Thai Airways, and ANA.

ProTip: The great thing about airline alliances is you can use your airline miles for one airline to fly on an alliance partner and vice versa.

The United website does a pretty good job of showing alliance partner award availability and allows you to book most award travel online.

To be clear, you can transfer your Ultimate Rewards points to United and book an award flight on United’s website operated by a Star Alliance partner, like Thai Airways.

Even better, United doesn’t pass on surcharges, even when you fly on a Star Alliance partner. However, United has moved to dynamic pricing, which means the number of miles you need for an award flight isn’t fixed. It fluctuates based on if you’re flying on United, one of their partners, seasonality, and demand.

United also allows open jaws and a free stopover or segment on award tickets when you take advantage of their Excursionist Perk. This perk is undoubtedly one of the best ways to redeem your United miles.

Southwest

For domestic travelers, Southwest offers terrific value because of its cheap fares within the U.S. and to destinations in the Caribbean, Central America, and Hawaii.

Southwest award flight prices are determined by the actual cash fare of the ticket. So, it’s best to book a Southwest award flight when they run a sale.

You can also cancel an award flight with no penalty, making it an easy, no-brainer move to rebook if and when you see a cheaper redemption.

But, should you transfer Ultimate Rewards points to Southwest?

Based strictly on the math, Ultimate Rewards points transferred to Southwest do lose a tiny bit of value. However, Southwest redemptions can be super cheap and even cheaper if you have the Southwest Companion Pass.

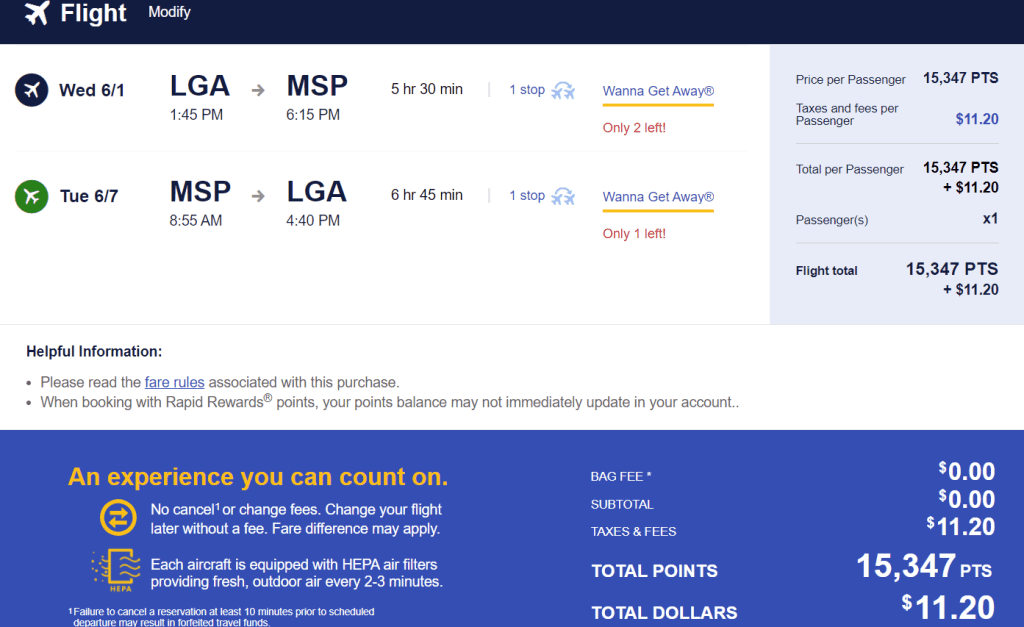

Let’s compare this Southwest award flight from New York-Laguardia to Minneapolis.

The total roundtrip price is 15,347 Southwest points and $11.20 if I booked through Southwest’s website.

That means I’d need to transfer Ultimate Rewards points to Southwest. The upside to this is having the flexibility to cancel the award flight and re-book should the price go down.

The Chase Ultimate Rewards travel portal doesn’t show Southwest flights in their flight search results. However, you can call ((866) 951-6592) Chase Ultimate Rewards to book a Southwest flight with an agent.

The above flight itinerary would cost more or less the same amount of points depending on whether you have the Sapphire Preferred or the Sapphire Reserve. Ultimate Rewards Points connected to a Sapphire Reserve get 1.5 cents per point in the travel portal, while Sapphire Preferred points return a 1.25 cents per point value.

When you book through the Chase travel portal, you lose the ability to cancel in the event of a better price, but you do earn Southwest Rapid Rewards Points for the flight.

Flights booked through the Ulitmate Rewards Portal look as if they’ve been paid with cash even when you’ve used points to book the flight.

Singapore Airlines

A member of the Star Alliance along with United, transfers to Singapore Airlines can return a solid value, even beyond the coveted First-class suites.

Singapore allows a free stopover on round-trip saver flights and has some redemptions which are cheaper than what United would charge.

For example, continental U.S. flights to Europe are 27.5k Singapore miles each way versus United’s 30k+ each way.

You can do even better if you fly one of the fifth freedom routes operated by Singapore Airlines. Flights from JFK-NYC to Frankfurt or Houston to Manchester cost just 22.5k Singapore Kris Flyer miles on an airline with better economy service than a legacy carrier like United.

Singapore has also partnered with Alaska Airlines, which lets you reach a difficult airline to access with flexible points. One-ways along the west coast are as cheap as 7,500 Singapore miles.

Singapore also charges less for United-operated flights to Hawaii than United charges!

Yet with all of the positives going for this Ultimate Rewards transfer partner, watch out for surcharges on Singapore Airlines. These fees can negate the value of an award ticket making it better to book elsewhere despite the low number of miles needed.

If you’ve never flown with them, here’s a review of Singapore Airlines.

JetBlue

JetBlue is another Chase Ultimate Rewards transfer partner that prices its awards based on the airfare’s cash price. Similar to Southwest, it’s best to book awards when JetBlue is having a sale.

Even though JetBlue is a transfer partner with Amex Membership Rewards and Citi ThankYou Points, Chase is the only transfer partnership to allow for 1:1 transfers and no fees to transfer Ultimate Rewards points to JetBlue.

But, is it actually a good value to transfer Ultimate Rewards points to JetBlue?

Based on the math, not really, and especially if you have the Sapphire Reserve.

Chase Ultimate Rewards points are worth more per point than JetBlue’s TrueBlue points. So, when you transfer your Ultimate Rewards points to JetBlue, you’re actually losing a bit of value.

The better play is to book JetBlue flights through the Chase travel portal. When you pay with points in the portal, you’ll still earn points with JetBlue when you fly.

That means Chase Sapphire Reserve cardholders, in particular, will get a 1.5 cent value per point and earn TrueBlue points.

Also remember, JetBlue flies to places like Alaska, Costa Rica, Ecuador, and the Caribbean. During a JetBlue sale, award flights to these destinations can be notably cheaper than booking with a legacy carrier like United, American, or Delta.

Flying Blue/KLM/Air France

Flying Blue is the loyalty program of both KLM and Air France.

Flying Blue awards are priced dynamically awards. The prices of awards vary depending on your origin, destination, cash price, and the demand for that flight.

Both Air France and KLM are SkyTeam Alliance members, along with Delta. They also partner with Virgin Atlantic. If you’re looking at a Delta award flight, it’s worth it to compare the pricing for that ticket with Flying Blue’s prices.

In addition, Flying Blue releases monthly Promo Awards which offer discounted award seats on select routes, typically between 25%-50%.

With this Ultimate Rewards partner, look for sweet spots to Israel, Europe, Hawaii, and northern South America. It’s also worth looking at Flying Blue for Caribbean awards, where you can fly on Delta-operated routes for fewer miles than what Delta might charge.

Again, watch for high fees! Some redemptions aren’t worth it given the amount of taxes and fees on the award ticket.

Virgin Atlantic

This transfer partner doesn’t get the love it deserves because of the hefty fees Virgin Atlantic imposes on its own award flights.

There are transatlantic flights to London that could make sense one-way (10k Virgin Atlantic miles to London!) and partner redemptions on ANA to Japan in business class and Delta redemptions domestically and to Europe, in particular, that stand out.

However, when I need Virgin Atlantic miles, I try to save my Ultimate Rewards points and transfer what I need from Amex Membership Rewards or Citi ThankYou Points.

Why?

Amex and Citi have relatively frequent transfer bonuses on points transferred to Virgin Atlantic. If you have Ultimate Rewards points, Amex Membership Rewards points, and/or Citi ThankYou points, try to plan in advance so you can take advantage of an Amex or Citi transfer bonus.

Save your Ultimate Rewards points for another redemption, if you can.

British Airways

British Airways is a member of the Oneworld Alliance along with American Airlines.

They are a distance-based award program, which means award flights are priced based on the number of miles flown. This works out well with nonstop short-haul inter-continent and inter-country flights in many places.

For example, it’s possible to redeem an award flight with British Airways between Los Angeles and Vancouver for 15k Avios round-trip but fly on an American Airlines plane since they’re the partner operating this direct route.

British Airways beginners are often surprised to learn that American Airlines would charge 25k miles for the same route!

For those of you looking for inter-Europe, inter-Australia, or even inter-Japan flights, British Airways can be a great option.

Alaska Airlines is now a member of the Oneworld Alliance, as well. Transferring Ultimate Rewards Points to British Airways gives you an indirect path to booking award flights with Alaska.

As with other transfer partners, you’ll want to watch for taxes and fees. Particularly on premium class award seats, these can be quite high.

Aer Lingus & Iberia Airlines

Iberia Airlines and Aer Lingus both use the same Avios currency as British Airways, yet they each have their own rules, award charts, and off-peak dates.

However, it is possible to move Avios between your British Airways, Iberia, and Aer Lingus accounts. This is a major plus because it means never leaving small amounts of Avios stranded in one of these accounts.

Aer Lingus is distance-based but has a sweet spot redemption from cities like New York, Boston, and Chicago to Ireland for as low as 13k Avios one-way off-peak.

Iberia flies from New York to Madrid for as low as 17k Avios each way off-peak in economy and only 34k Avios one-way in Business class. Iberia often charges less in taxes and fees than British Airways, too.

Iberia also differentiates itself from British Airways in that the number of Avios needed is based on total trip mileage, even when your route includes a connection.

In this instance, British Airways would charge per segment and most certainly be a more expensive award. This makes it possible to consider Iberia when booking award tickets that have a stop.

Where Iberia really shines, though, is with domestic flights operated by American Airlines. Both airlines are in the Oneworld alliance which means Iberia Avios can be used to book AA award flights for cheaper than AA would charge.

Whenever you’re looking to book flights within the U.S on American Airlines, it’s worth it to price the award on Iberia, too.

Emirates

Emirates is synonymous with luxury. Their 777 and A380 premium class seats are a true splurge!

If you’re already in Europe, there are great Emirates Business Class redemptions to Dubai. For just 135k Emirates miles, you can fly round-trip to Dubai in Business Class from cities like Frankfurt, Paris, and Brussels.

Ironically, one of Emirates fifth freedom routes, NYC-JFK to Milan is one of the best business-class deals to this northern Italian city. At just 90k Emirates miles round-trip on the A380, you’ll have a luxurious lie-flat seat and access to the Business Class bar on board.

Emirates also partners with JetBlue so domestic flights operated by JetBlue but paid for with your Emirates miles can be a great deal. Not to mention far-flung places like the Maldives and Tanzania can be reached with your Emirates miles.

Air Canada Aeroplan

Air Canada Aeroplan is a member of the Star Alliance along with airlines like United and Singapore Airlines.

Aeroplan has different award charts based on geographic zones. Within those zones, there are tiers based on the distance flown to determine award pricing.

Short-haul sweet spots domestically and within Canada cost up to 10k Aeroplan points. Some of these short-haul routes can be quite expensive cash tickets, making this a great deal. Think, for example, of routes in eastern Canada to places like New Brunswick, Nova Scotia, and New Foundland.

Aeroplan charges less for United flights to Hawaii than United would charge for its own flights. Star Alliance Business Class flights to Europe are only 60k-70k one-way depending on where you’re flying to in Europe.

West coast flights to Asia can be as little as 55k Aeroplan points one-way in Business class.

Aeroplan also allows you to add a stopover to an award itinerary for just 5k extra points.

Just beware that while Aeroplan has eliminated fuel surcharges, there is an unavoidable $39CAD per person booking fee when using Aeroplan to book award flights.

Chase Ultimate Rewards Hotel Partners

These are the Chase Ultimate Rewards hotel partners.

- Hyatt,

- IHG, and

- Marriott

Similar to the airline transfer partners above, your Chase Ultimate Rewards points will transfer 1:1 to all of these hotel partners.

Hyatt

Hyatt represents the best value among all of Chase’s hotel transfer partners, and arguably among all of its transfer partners combined.

Award nights range from 5k-30k points and the math on per-point redemption value can easily go up and over 2 cents per point. Hyatt cash and points bookings can also be a fantastic value.

The one downside is that Hyatt doesn’t have as many hotels worldwide compared to brands like Hilton or Marriott, however, this is changing as Hyatt continues to grow its footprint around the globe.

Hyatt award its loyalty members with fantastic perks like free breakfast, suite upgrades, late check-out, and free parking on award nights.

ProTip: Looking to book an all-inclusive stay with points? Check out Hyatt’s Zilara and Ziva properties in Mexico and Jamaica for a great value.

IHG

IHG hotels include brands like InterContinental, Holiday Inn Express, and Crown Plaza. There are also boutique brands like Kimpton Hotels and Hotel Indigo that offer a unique style and even pet-friendly rooms.

IHG points are valued at about 0.7 per point, well below the 2-ish cents per point of Ultimate Rewards points, making transfers to this partner a losing proposition.

IHG points can be earned in a variety of ways and the IHG Rewards Club Premier comes with an anniversary night each year at a hotel up to 40k points a night.

Consider that even using the cash & points trick to book IHG award nights can be a better value than transferring Chase Ultimate Rewards Points.

Marriott

Marriott Bonvoy is a huge loyalty program with numerous hotel brands all over the world. There’s likely always to be some Marriott property whether your destination is a National Park or a trip to Scandinavia.

Yet, as with IHG, transferring Ultimate Rewards points for award nights to Marriott is not a great value.

If you’d like to earn Marriott points for an award stay you’d like to book, you’re better off applying for a co-branded Marriott credit card rather than transferring valuable Ultimate Rewards Points.

What about that Chase Ultimate Rewards Travel Portal?

Even with all of these fantastic transfer partners, there are times when it might make sense to use Chase’s travel portal to book flights and hotels.

Keep in mind, when booking through the Chase Ultimate Rewards travel portal, pay careful attention to the cancellation policies. You want to steer towards travel bookings that can be canceled directly from within the portal.

For Chase travel portal bookings, here are some factors to consider.

- For flights, the portal searches in the same way you’d search on a travel booking site. You’re not limited to flights with just the transfer partners. This means flight search results will include many flights on a variety of airlines.

- If you have no flexibility or just want to find the cheapest possible economy price, booking through the portal may be a better option, both in terms of schedule and the number of Ultimate Rewards Points needed to book.

- However, if you want a premium seat, it’ll nearly always be a better value to transfer your Ultimate Rewards Points to a transfer partner rather than book business or first-class flights in the portal.

- You’ll likely earn miles for flights booked in the portal with Ultimate Rewards Points because they appear as cash bookings to the airline.

- For hotels, the Ultimate Rewards travel portal opens up many more hotel possibilities than just the typical loyalty program hotels. Using your Ultimate Rewards Points here, especially if you have the Chase Sapphire Reserve with its 1.5 cent redemption rate in the portal, can absolutely make sense. However…

- Don’t book too close to your check-in date or during a peak holiday time when cash prices are higher and therefore Ultimate Rewards portal redemption rates are higher.

- Do compare loyalty program hotel redemption rates with the number of Ultimate Rewards Points needed for the same hotel in the portal.

- Remember, booking a loyalty program hotel like a Hilton or a Marriott through the Chase portal usually means not earning loyalty program points for the stay and forgoing any status-related perks.

Chase’s Ultimate Rewards transfer partners are what make your Ultimate Rewards Points so incredibly valuable! In turn, this makes Chase’s portfolio of travel rewards cards especially valuable.

When transferred effectively, your Ultimate Rewards points can have you sitting in airplane seats you previously thought were too expensive and on your way to bucket list destinations!

Which Chase Ultimate Rewards transfer partner has given you the most value?

Like this post? Please share it on social media using the share buttons below.