Disclosure: The Globetrotting Teacher may receive commission from card issuers. Some or all of the card offers that appear on the The Globetrotting Teacher are from advertisers & may impact how & where cards appear on the site. The Globetrotting Teacher does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Are you wondering how to transfer Chase points to Hyatt?

Well, you’re in the right place!

In this guide, I’ll walk you through how to transfer Chase Ultimate Rewards points to Hyatt. Plus, we’ll talk through when it makes sense to transfer to Hyatt and when it might not make sense.

How to Transfer Chase Ultimate Rewards for a Hyatt Stay

Most beginners to the miles and points hobby focus on earning miles for reward flights first. Earning enough miles to fly for free certainly helps you save money for your travel budget.

Hotel stays, though, can also take a chunk of the travel budget which makes earning points for reward stays an important piece to any travel hacking strategy.

Once you finally earn enough points to book your travel, you’ll need to know how to use travel transfer partners to get maximum value for your hard-earned points.

Hyatt is arguably Chase’s best transfer partner. There’s a lot of value to be gained by using Chase Ultimate Rewards points for award nights at Hyatt properties.

Best of all, once you know how to transfer points to Hyatt, just repeat the process to transfer points to any other Chase transfer partner.

Earning Chase Ultimate Rewards Points

You could earn Hyatt points directly with the World of Hyatt Credit Card or the card_name.These co-branded Hyatt hotel credit cards also come with perks for brand loyalists.

Luckily, too, Chase Ultimate Rewards points are easy to earn. (Ultimate Rewards points are also the flexible points to start with for anyone new to points and miles.)

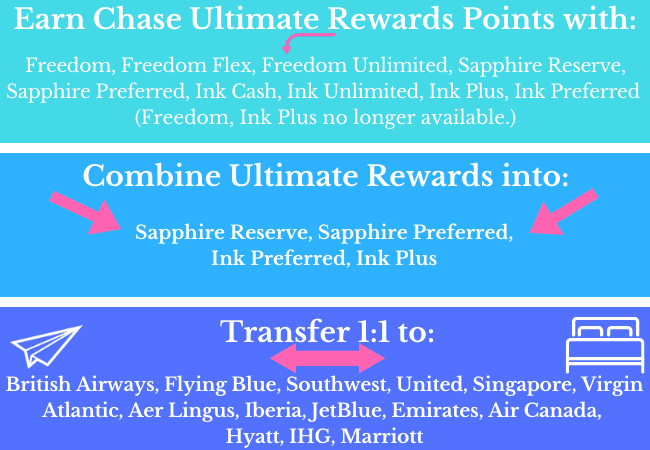

Chase has a strong lineup of Ultimate Rewards earning credit cards. Some cards earn Ultimate Rewards points and have access to Chase’s transfer partners all by themselves. These include:

Other Chase credit cards earn cashback rewards on their own and don’t have access to Chase’s transfer partners. These cards are:

BUT, when one of the Freedom cards or the Ink Cash or Ink Unlimited is paired with a Sapphire or the Ink Preferred, their cashback rewards can be combined as regular Ultimate Rewards points.

Once the points are combined with Ultimate Rewards points earned with a Sapphire or Ink Preferred, they now have access to Chase’s transfer partners, including Hyatt.

Here’s a graphic so you can see how this looks in action. 🙂

To sum this up, you must have one of the Sapphires or the Ink Preferred to have access to Hyatt and Chase’s other transfer partners.

You can read my Sapphire Reserve card review and my Sapphire Preferred card review to learn more about these Ultimate Rewards credit cards.

How to Transfer Chase Points to Hyatt

Hyatt has gorgeous properties around the world that’ll give an excellent return value on your Ulitmate Rewards points.

Before we continue, make sure you have completed the following:

1. You must know how to log in to your Chase Ultimate Rewards credit card account.

If you haven’t set up your online access yet, simply do a Google search for “Chase Ultimate Rewards.” Then, choose the “Not Enrolled” option and follow each step to set up your username and password.

2. You must also have a World of Hyatt member number.

If you don’t, you can sign up here for free.

ProTip: This guide has everything you need to know to navigate and use your Chase Ultimate Rewards account.

Once these are set, you’re ready to transfer your Chase Ultimate Rewards points to Hyatt.

Log in to your Chase account.

Keep in mind, there are two ways to access the Chase Ultimate Rewards portal.

1. From your Chase accounts page, you can click on your Ultimate Rewards balance to go to the Ultimate Rewards Portal.

OR

2. Go directly to the Chase Ultimate Rewards Portal and use your Chase username and password to log in.

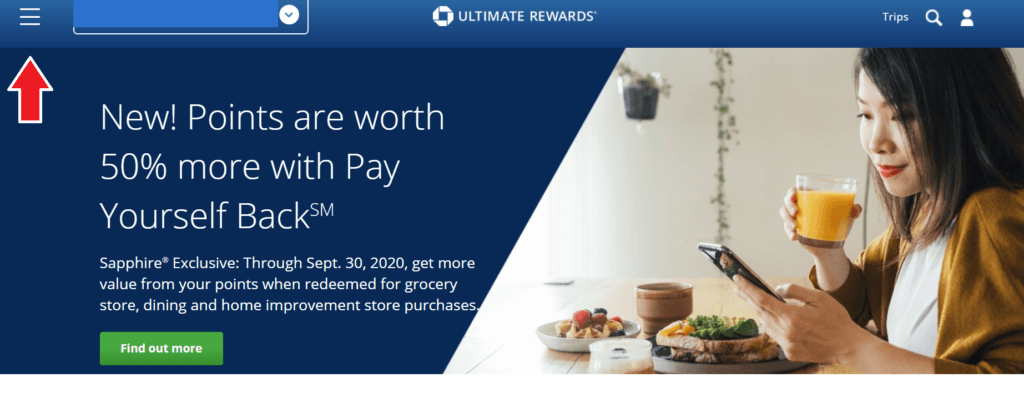

Once you log in, and if you have more than one Ultimate Rewards credit card, you’ll be prompted to choose which Chase credit card points balance you want to access.

If you have only one Chase credit card that earns Ultimate Rewards points, you’ll be taken directly to the main screen.

Remember, choose your card_name, card_name, or card_name so you can have access to Chase’s transfer partners.

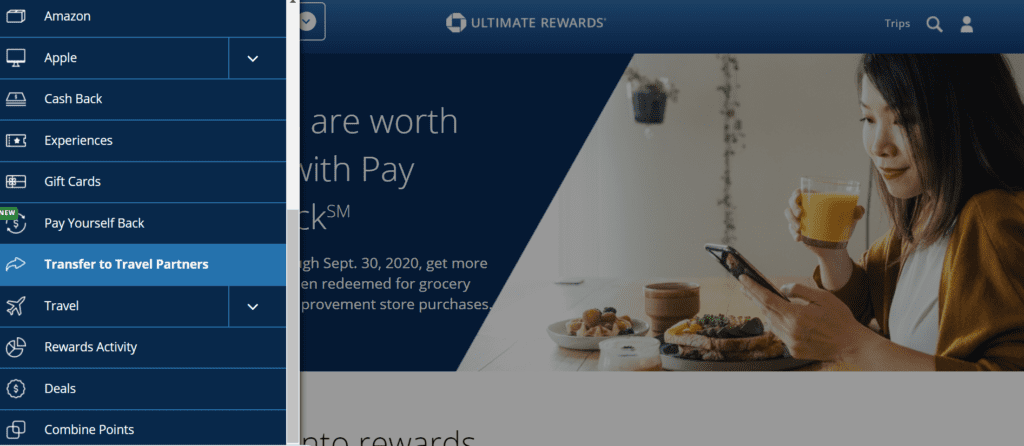

Click the drop-down menu in the top left corner and select the “Transfer to Travel Partners” option from the menu.

The next page on your screen will list all of Chase’s airline and hotel travel partners. Scroll down to the list of hotels. Chase’s hotel transfer partners are Hyatt, IHG, and Marriott.

By clicking on the arrow next to the “Transfer Points” button, the Hyatt row in the chart will drop down and show additional information.

The Hyatt brands and their logos are shown. Importantly, though, in the bottom left corner is the time it will take for the points to transfer. Chase Ultimate Rewards points will transfer to your Hyatt account instantly.

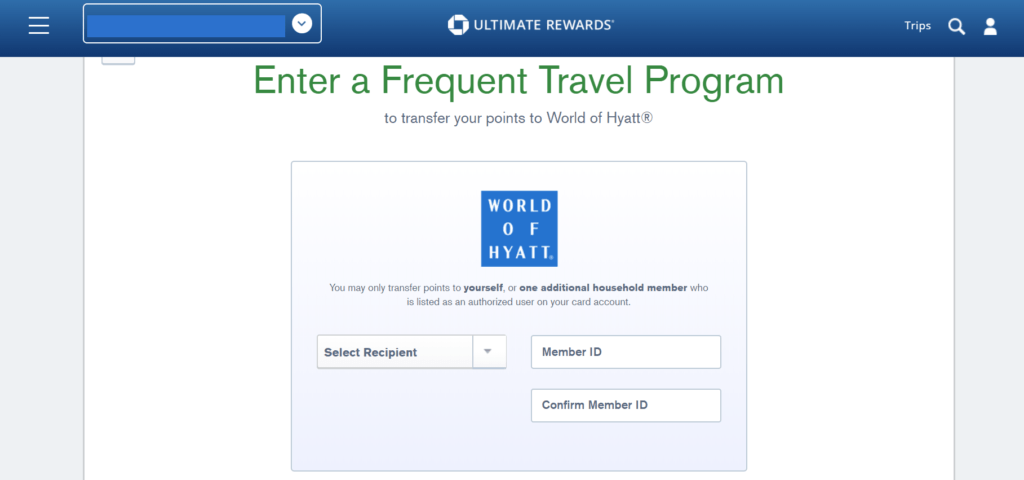

Now, click the “Transfer Points” button in the Hyatt row in the table of hotel transfer partners. If it’s you’re first time transferring Chase points to Hyatt, you’ll be prompted to enter your World of Hyatt loyalty member information.

Chase allows Ultimate Rewards points to be transferred to a loyalty account belonging to the primary cardholder and one authorized user who lives in the same household.

For Chase business credit cards, points may be transferred to the primary cardholder and one authorized user who is also an owner of the business.

Once set up, select the recipient of the person who is to receive the points transfer. Enter the World of Hyatt number twice to confirm. Then, click “Continue.”

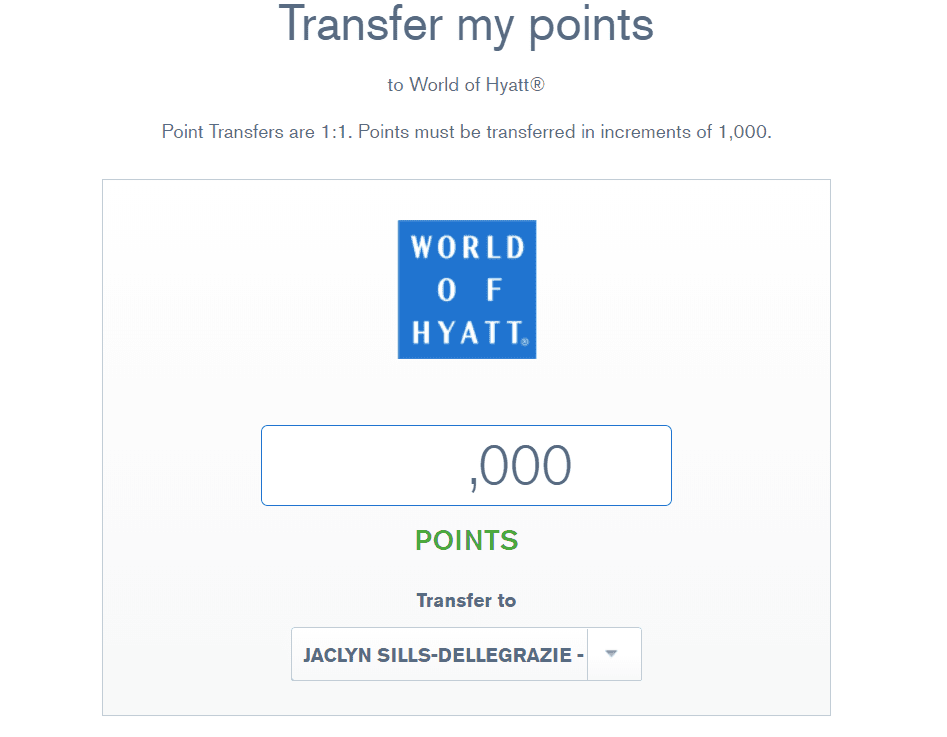

On the next screen, type in the number of points you’d like to transfer from your Chase account to Hyatt.

Points can be transferred in increments of 1,000 and transfer at a 1:1 ratio. As a general rule, when transferring flexible points like Ultimate Rewards to a transfer partner only transfer the number of points you need for your redemption.

Your points will retain their value as flexible points in the bank ecosystem and won’t lose value if the loyalty program they’re sitting in devalues.

And, never transfer points to any partner until you’ve found the award flight or award night you want to book. Once flexible points transfer to partners, they can’t be transferred back.

You can search on the Hyatt website for award night availability and check the Hyatt Award Chart for current pricing.

Continue onto the next screen. You’ll have the opportunity to review your transaction once more before completing it.

On this final page, review everything carefully. Make sure your World of Hyatt member number is correct. Make sure you have typed in the correct amount of points to transfer.

All transfer transactions are final and cannot be reversed.

If everything appears as it should, click the green “Confirm & Submit” button. After a few seconds, you will see a “Congrats!” page confirming the transfer was a success.

To verify, log in to your Hyatt account to see the points registered in your account. (If you had your Hyatt account open beforehand, you may need to refresh the page to show your new points balance.)

Is it ever not worth it to transfer Ultimate Rewards to Hyatt?

In most cases, you’ll get a terrific value when you transfer Chase points to Hyatt. But, it’s still important to do the math on the redemption.

This is simply done by checking the cash price for the award night you want to book. Then divide that amount by the number of points needed to redeem.

Generally, you should always aim to get at least 1.5 cents per point for your Ultimate Rewards points.

If the Hyatt redemption you’re eyeing up is less than 1.5 cents per point, you may want to think about whether this redemption is worthwhile for your travel plans.

Remember, if you have a card_name, you can already redeem your points for 1.5 cents per point value by booking travel directly through Chase’s travel portal. This includes nights at Hyatt properties. card_name and card_name cardholders can redeem Ultimate Rewards points in the Chase travel portal for 1.25 cents per point.The downside to booking Hyatt stays through the Chase travel portal, though, is you don’t get the benefits of any Hyatt status you may have, nor do you earn elite nights or points for your stay.

Typically, transferring your Chase UR points to Hyatt is a great value, and even considered by some as the best possible use of your Chase points.

But you should always do your homework to make sure you’re maximizing your hard-earned points.

Enjoy your Hyatt award stay!

Which Hyatt award stay was your favorite?

Like this post? Please share it on social media using the share buttons below!

Learn more points and miles basics in my FREE Travel Hacking Basics course.