The Chase Sapphire Reserve is Chase’s premium travel rewards credit card that earns flexible Ultimate Rewards Points.

Since launching, it’s become a favorite miles and points credit card because of its earning potential, redemption possibilities, and perks. I always have this credit card in my wallet whether I’m traveling or using it for everyday purchases.

This guide covers all the card’s perks and benefits so you can decide whether or not the Chase Sapphire Reserve makes sense for your travel wallet.

What You Need to Know About the Chase Sapphire Reserve

The Chase Sapphire Reserve is one of two cards in Chase’s Sapphire card family.

The other Sapphire card is the Chase Sapphire Preferred and by clicking on the link you can read my guide on that card.

Both cards earn transferrable Ultimate Rewards points to redeem for flights and hotels with Chase’s transfer partners. However, the Sapphire Reserve comes with its own welcome offer, perks, and benefits.

Note: The welcome offer details below may not be 100% accurate. These offers change regularly and, although I do my best to keep everything updated, the best way to confirm the current offer details is to click the card link or go directly to Chase’s website.

Chase Sapphire Reserve

Current Welcome Bonus: Earn 60,000 points after spending $4,000 in the first 3 months from your account opening.

Favorite Card Features:

- $300 travel credit

- 5x on flights booked through the Ultimate Rewards Portal

- 10x hotels and rental cars booked through the Ultimate Rewards Portal

- 10x Lyft rides

- 3x on other travel and dining

- 1x on all other purchases

- Priority Pass Select Membership

- $100 credit for Global Entry or TSA Pre✓

- No foreign exchange fees

- Transfer Ultimate Rewards points to airline and hotel partners like United, Iberia, and Hyatt

- 1.5 cents per point value if you redeem points for travel in the Chase Ultimate Rewards Portal

- Member FDIC

Annual Fee: $550

Earning Ultimate Rewards

Chase Sapphire Reserve comes with lucrative bonus categories to help you earn even more Ultimate Rewards points for your spending.

You’ll get 3x the points when you make travel or dining purchases. If you book travel through the ChaseTravel Portal, you’ll earn 10x the points on hotels and rental cars and 5x the points on flights.

Shop through Chase

In addition to the bonus categories listed above, you can log into your Ultimate Rewards account and earn more Ultimate Rewards through Chase’s shopping portal.

If you’re not sure how shopping portals work, it’s easy. Simply click on the merchant you want to shop with from the shopping portal instead of going to that merchant’s website directly.

With Shop through Chase, you’ll earn whatever the stated earn rate is for that merchant, plus the points you’d earn with your Sapphire Reserve on the purchase.

I’ve earned thousands of Ultimate Rewards points over the years from Chase’s shopping portal.

It may not seem like a lot at the time, but those points add up, especially when you realize the 500 points you earned from a recent purchase got you to the amount you needed to book an award flight.

Chase Sapphire Reserve Benefits

The Chase Sapphire Reserve comes with a suite of benefits designed with travelers in mind.

The card has several ways to earn bonus Ultimate Rewards Points which can eventually be redeemed for award travel, as well as perks to help make your travel experience more comfortable.

Let’s take a look at the benefits Sapphire Reserve offers.

Sapphire Reserve $300 Travel Credit

One of the most notable of all the card benefits, the $300 travel credit is my favorite. It’s simple and straightforward to use. Just make purchases in the travel category and up to $300 will be credited.

Flights, hotels, car rentals, and cruises will trigger the credit but so do tolls, trains, commuter costs like parking and subway cards, as well as rideshare services like Lyft and Uber.

This $300 travel credit is tied to your card member year (not the 12-month calendar) and resets when you renew your card.

If you log in to your Sapphire Reserve Ultimate Rewards, there’s a dashboard that shows how much of the travel credit you have received.

If you’re someone who would have spent $300 in a year on travel anyways, then this travel credit essentially cuts the annual fee to $250.

Chase Sapphire Reserve Airport Lounge Access

Priority Pass has a vast network of lounges located in airports around the globe. Your Sapphire Reserve card gives you Priority Pass Select membership.

With Sapphire Reserve, you and 2 guests have free entry to all Priority Pass lounges.

Lounges come with a variety of amenities like complimentary meals, snacks, drinks, lounge-specific wifi, restrooms, and comfortable spaces whether you’d like to relax or need to get some work finished.

In addition, Chase has begun opening Chase Sapphire Lounges in airports. For now they’re mostly in U.S. airports but there is also a location at the Hong Kong Airport…with great food! (I’ve done the legwork.)

In all seriousness, I love this Sapphire Reserve benefit.

Having a credit card with lounge & restaurant access has saved my family and me a lot of money on food and drinks, not to mention the luxury of having a space away from the hustle and bustle in the main airport terminal.

$120 Credit for Global Entry or TSA PreCheck

I don’t like waiting in long lines at security and Customs when departing for or returning from a trip and I’m guessing you don’t either.

When you apply for Global Entry or TSA PreCheck and pay with your Sapphire Reserve, you’ll get the cost credited on your card’s statement.

Once you’re approved, you’re good for 5 years.

You’ll get to use the TSA PreCheck lanes at security and you won’t need to take everything out of your bag. Global Entry allows you to use specially designated kiosks to re-enter the country at Customs and Border Control.

It makes the most sense to apply for Global Entry because it includes TSA PreCheck and the fee is $120, exactly the amount of the statement credit. It doesn’t work in reverse, though. TSA PreCheck does not include Global Entry.

This perk is worth its weight in gold!

When security and customs are chaotic and have long lines, I can skip it all and use the designated lanes for this expedited servce. And if you already have Global Entry, you can use the credit to pay for a family member who doesn’t!

No Foreign Transaction Fees

Perhaps obvious, but very important nonetheless.

Sapphire Reserve is made for travel. So bring it with you wherever you’re heading on your next trip.

You won’t be charged any foreign transaction fees on purchases made abroad.

Sapphire Reserve Primary Car Rental Coverage

Raise your hand if you’ve ever been at a rental car counter with your eyes spinning as the representative upsells you on different types of insurance.

I love knowing that with my Sapphire Reserve I am protected against damage for the cost of a typical rental car. It helps me to sort through what additional coverage I might want to pay for and what I don’t need to add to my rental car cost.

To trigger the Sapphire Reserve primary car rental coverage, you must decline the CDW coverage offered by the rental agency.

And while it’s definitely one of those perks where it pays to read all the terms and conditions to understand exactly what is covered, there’s no denying how much money you can save when you don’t have a per-day charge for CDW on a rental car.

You get the added security of knowing you’re covered for vehicle damages and the money saved can easily offset the rest of the card’s annual fee (after the $300 travel credit) from just one trip.

Sapphire Reserve DoorDash DashPass & Monthly Credit Benefit

Chase Sapphire Reserve cardholders get one complimentary year of DashPass as long as you activate it before the end of 2027 and you keep your card open.

Order through DoorDash and you’ll have no delivery fees. Plus, you’ll get reduced service fees on eligible orders.

Sapphire Reserve cardholders also get $25 a month in DoorDash promos, including a $5 monthly restaurant credit and two $10 promos for non-restaurant DoorDash orders.

The Edit by Chase Travel

The Edit by Chase Travel offers luxurious benefits at over 1,000 accommodations around the world. If you have a Chase Sapphire Reserve, you have access to book through The Edit and take advantage of these perks.

When you book a stay through The Edit by Chase Travel with your Sapphire Reserve, you’ll get breakfast for 2, complimentary wifi, an upgrade (if available), early check-in/out, as well as a special property-specific amenity worth up to $100.

What an easy way to add luxury to your hotel stay while taking advantage of fantastic property privileges!

Visa Signature Benefits

Sapphire Reserve is also part of the Visa Signature family, which comes with specific travel protections.

You’ll want to read more about the terms and conditions for each of these perks but they include coverage for things like:

- baggage delays,

- lost luggage,

- trip interruption/cancellation,

- emergency evacuation and transportation for you, your spouse, and children under the age of 19.

- purchase protection,

- roadside assistance, and,

- warranty assistance.

Redeeming Ultimate Rewards Points

Now comes the fun part! You get to use the points earned with Sapphire Reserve for fabulous travel experiences!

There are a lot of possibilities, but if you need some ideas and inspiration about how to use your Ultimate Rewards points, I’ve put together this guide and this guide.

Redeem for 1.5 cents per point in the Chase Travel Portal

By far the most straightforward way to book flights, hotels, and more, Sapphire Reserve cardholders get 50% more value on every point redeemed in the portal.

This adds up to a 1.5 cent-per-point value instead of the 1-cent value with one of the Chase Freedoms or a 1.25-cent value with the Sapphire Preferred or Ink Preferred.

I’ve found the Chase Travel Portal most useful when booking cheap flight deals and small, independent hotels in places where it isn’t possible for me to use hotel points for award nights.

ProTip: Combine all your Ultimate Rewards points with your Sapphire Reserve. Not only does it make sense to keep one balance of points, once combined, all of your points benefit from the 1.5-cent value.

Transfer to Airline and Hotel Partners

1.5 cents per point for your Ultimate Rewards is a good value but it’s possible to get even more.

Chase has airline and hotel transfer partners and when you transfer your Ultimate Rewards to some of these partners, you have the ability to book award flights and hotel nights above and beyond the 1.5-cent valuation.

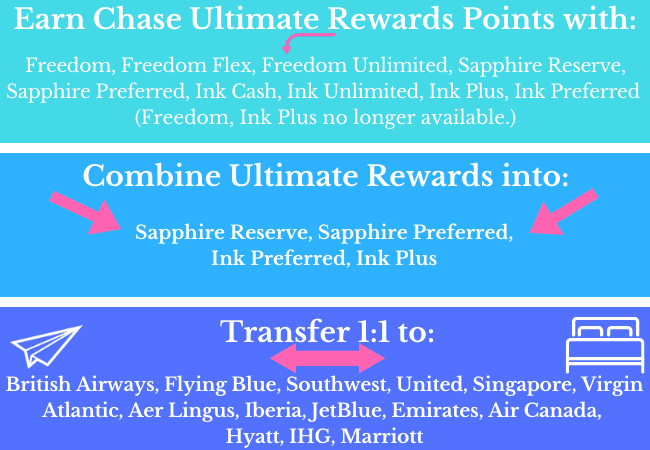

Not all Chase cards come with the ability to access these transfer partners on their own, but Sapphire Reserve does. You can see how it works in the diagram below.

There’s a learning curve about how best to use these partners. However, these partners make it possible to redeem your points for premium-class seats on flights and stay at fantastic hotels, particularly through Hyatt.

ProTip: Know how to transfer your flexible points. Point transfers are irreversible. Never transfer Ultimate Rewards points until you know that what you want to book is available.

The annual fee is too high! Why would I pay for that?

For those of you wondering if paying the annual fee is worth it, understand this is a question you should continually ask with any and all of your credit cards regardless of how high or low the card’s fee is.

I get it, though. At first-glance, it’s easy to cringe at the steep annual fee.

The first thing to consider with the Chase Sapphire Reserve is the $300 travel credit.

This travel credit can be used broadly for typical travel expenses like airfare and hotels, but also for parking fees, subways, commuter trains, and tolls.

So if you’re someone who would normally spend $300 a year on travel expenses or even commuting costs, you’ve offset a big chunk of the annual fee.

And if you’re interested in a card like the Chase Sapphire Reserve, chances are you’re already someone who spends $300 a year in travel-related purchases. So, why not spend that money as usual and get additional perks as a cardholder?

The annual fee reduces itself further and could even pay for itself entirely If you use just a couple more of the primary perks like:

- $120 credit for Global Entry,

- Free food, drinks, and wifi with the Priority Pass Select Lounge membership for you and 2 guests, and/or,

- redeem with a 50% added value in the Chase Travel Portal often.

This is all before you put a value on the Ultimate Rewards Points you can earn with Sapphire Reserve, as well as from additional perks like DoorDash.

As always, though, the perks must outweigh what you’re paying in an annual fee to justify the cost.

For me, I easily offset the fee on the card by always using the travel credit, using the airport lounges instead of buying food or drinks at the airport, to pay for Global Entry, and by continually earning points that I can redeem for award travel.

Will I be approved for the Chase Sapphire Reserve?

Chase’s approval rules are centered squarely on the 5/24 rule.

If you’ve opened more than 5 credit cards from any bank over the last 24 months, you could get denied regardless of your credit score or financial profile.

For this reason, miles and points beginners should start with credit cards from within the Chase Ultimate Rewards family (Sapphire Reserve, Sapphire Preferred, Freedom, Freedom Unlimted, and Ink Preferred). All of these can help you book award travel around the globe.

Learn more about the first 5 Chase cards you should start with in order to maximize your points and miles earnings.

Chase also added a “Family Rule” to the Sapphire cards and extended the amount of time before you’re eligible for another Sapphire welcome bonus.

You can only have one card in the Sapphire “family” at a given time. And, it must be at least 48 months since you’ve last received a Sapphire welcome bonus to earn another.

What if I already have the Chase Sapphire Preferred?

Unfortunately, you can’t hold both Sapphires at the same time.

If you already have the Sapphire Preferred and you think the perks of the Chase Sapphire Reserve are better suited to your spending and travel needs, here’s what you need to consider.

Has it been less than 48 months since getting a Sapphire Preferred welcome offer?

- If yes, you could call Chase and upgrade to the Sapphire Reserve.

- If no, keep reading.

If you answered yes to the above, you wouldn’t earn a welcome offer but you’d get access to the higher-earning rates and travel perks, like Priority Pass Membership, 50% bonus in the Travel Portal, the Global Entry credit, DoorDash perks, and the $300 travel credit.

If it’s been more than 48 months since you received a welcome bonus on your Sapphire Preferred, you could:

- Downgrade that card to a Freedom Flex or Freedom Unlimited.

- Wait a billing cycle.

- Then, apply for the Sapphire Reserve.

Just a few things to keep in mind if you plan to downgrade.

Make sure you have another credit card like the Ink Business Preferred or a spouse with an Ink or a Sapphire to ensure you still have access to Chase’s airline and hotel transfer partners.

If you don’t, it’s not a good idea to downgrade. Any Ultimate Rewards points in your account would immediately devalue to a fixed 1 cent per point value and only be usable for the Chase travel portal and cashback rewards.

Bottom Line

The Chase Sapphire Reserve is worth it for travelers who want to maximize their spending on travel and dining, take advantage of valuable benefits like lounge access, and have the ability to redeem for award travel with valuable Chase transfer partners like Hyatt and United.

Best of all, I can confidently recommend that you take a look at this travel rewards credit card because I’m a cardholder myself.

It’s easily one of my most favorite credit cards for travel perks and award travel which has earned it a permanent place in my travel rewards wallet.

Let me know if you have questions about the Chase Sapphire Reserve.

Like this post? Please share it on social media using the share buttons below!