If you’ve got questions about travel hacking and credit cards, you’re not alone.

Credit cards and what they may or may not do to your credit score are always a big part of what beginners and skeptics alike want to know.

In this post, let’s address some of these credit card myths, as well as look at credit card best practices, and even whether or not travel hacking is right for you.

Ultimate Guide to Travel Hacking:

Credit Cards Part 1

Let’s first consider the results of a study commissioned by The Points Guy in which Americans were surveyed about what they knew about travel rewards credit cards.

- A mere 1/3 of people answered yes when asked if they had a credit card that earned miles and points. Just 10% said they had 2 or more travel rewards credit cards.

- 1/3 of the people with travel rewards credit cards had no idea if their card came with foreign transaction fees or not.

- Nearly 3/4 of the survey participants said they never checked with banks to learn about the latest or the most lucrative sign-up offers.

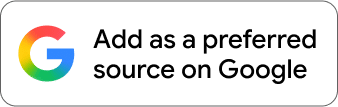

Step 1- How is your credit score calculated?

It’s not entirely clear why the majority of Americans are so in the dark about travel rewards credit cards. However, there seems to be a lot of myths and misconceptions surrounding credit scores, credit cards, and how the two affect one another.

This misinformation and the concerns over whether you’re making a good or bad credit decision are enough to stop many people from taking advantage of the incredible travel rewards that are out there.

You don’t have to be one of these people. You can take that BIG trip without saving money for years and years!

Are you ready for your Travel Hacking Economics Class? (collective groans, I know.)

I promise it won’t be that bad!

1. Watch this 2-minute video below to learn how your credit score is calculated.

2. Let’s debunk the most common credit score myths.

Now that you understand the factors used to calculate your credit score, it’s also time to let go of credit score myths that are holding you back from earning valuable travel rewards.

Won’t too many credit cards hurt my credit score?

No. The number of credit cards you have does not hurt your credit score. In fact, if you’re responsible with your credit cards and pay your bills off on time each month, your credit score is likely to improve. Here’s why.

Credit scores reflect how much of your available credit is in use.

If you have 1 credit card with a $5,000 limit and $2,500 of that is a balance you’re carrying, then 50% of your available credit is in use.

Compare this with someone who has 4 credit cards for a total $25,000 spending limit and the same $2,500 balance. Only 10% of the credit available is in use.

People who use less than 30% of their available credit are considered low-risk. As a result, their credit score goes up.

Ok, but won’t applying for all those credit cards hurt my credit score?

How long your accounts have been open counts for 10% of your credit score.

With each new account, the average age of your accounts gets younger. This can cause anywhere between a 2-10 point TEMPORARY dip.

Remember you’ll also have more credit available to you so the percentage of how much of your credit is in use will go down and your credit score will go back up and just might even improve!

Shouldn’t I carry a balance to improve my credit?

No. The less debt you have the higher your credit score will be. The lower that in-use percentage is from above the better it will be for your credit score.

Also from a travel hacking perspective, paying high interest on balances cancels out the value of the miles and points you’re earning.

Debit cards are better than credit cards for your credit score, though, right?

Absolutely not! Debit cards aren’t tracked on your credit report and have no impact whatsoever.

Not to mention, your money isn’t working for you. You’re in a cycle of earning money and paying bills with no reward.

If you’re responsible about spending and paying off the balance each month, put your debit card away and use your credit card for bills and everyday spending.

I’ll never have a good credit score because I don’t make a lot of money.

The amount of money you make has nothing to do with your credit score. As long as you spend within your means and pay your bills off each month, your credit score will positively reflect that no matter how much your paycheck is each week.

Remember, there’s a teacher writing this and we all know that teachers don’t make a whole lot. At last check, my credit score was an excellent 832!

3. Find out your credit score.

If you don’t have a credit card that gives you access to your credit score, you can use Annual Credit Report to get your credit score free once every 12 months.

You can also use a service like Experian where for $1 you can check your FICO score.

Step 2- Credit card best practices for travel hacking

Use your travel rewards credit cards for everything.

By everything I mean, everything you have to buy or pay for that accepts credit cards. From your cable bill to car insurance to doctor’s office co-pays to Netflix and your morning coffee, pay with your travel rewards credit card.

You get no return from paying your bills and buying groceries with money directly from your checking/savings account.

Put your debit card away and make your money work for you every time you use your travel rewards card! Even an airline credit card or hotel credit card is better than using your debit card.

Spend smarter, not more.

Use your travel rewards credit card for the same things that would’ve normally come out of your bank account or been purchased with a debit card.

But, do not spend more than you can pay off at the end of each month!

Pay your monthly balances in full.

Travel rewards credit cards typically come with high-interest rates. If you carry balances, the amount you’ll pay in interest fees will cancel out the value from the miles and points you’re earning.

This completely defeats the purpose of using these travel rewards credit cards.

Keep no annual fee credit cards open forever.

Remember the older the age of your accounts, the better your credit score will be. You can selectively use these cards without worrying whether or not there’s value in paying the annual fee.

The only caveat might be in the case of a bank that limits the number of their cards you can hold at a given time.

In this case, closing a no-fee card that you no longer get any benefit from might make sense to make room for a different card and its welcome bonus.

Apply for new credit cards wisely.

Of course, you want to take advantage of large sign-up bonuses. Just be sure your budget allows for the minimum spend to earn that bonus.

There’s no point in applying for 2 credit cards at the same time if you can’t earn the bonuses.

Some travel hackers apply for 2-3 cards at a time with 3-4 months in between each round of applications. Others prefer to target specific cards or wait for higher-than-usual sign-up bonuses.

Do what’s right for you, your finances, and your travel goals.

Close credit cards strategically.

Keep credit cards open for at least the first year. You’ve either paid the annual fee for the year or it was waived. Either way, the longer the account is open the better it will be for your credit score.

Banks also take note of people who apply only for a bonus and then close the card shortly thereafter. This practice can definitely make it more difficult to get that same bank to approve you for new cards in the future.

However, evaluating your credit cards is an important part of earning travel rewards. An effective long-term strategy includes closing cards when they no longer serve your needs or offset the annual fee.

Before you cancel a card, always call the bank to see if there’s a retention offer that makes it worthwhile to keep the card for another year. You can also check to see if a no annual fee version of that card exists and whether it’s possible or smart to downgrade your card instead of closing the line of credit.

If you do decide to cancel a card, do it right after you’re approved for any new cards.

Step 3- Is travel hacking right for me?

We can dive into the specifics of different kinds of credit cards, the credit cards every beginner should start with, ways to meet minimum spend requirements, and annual fees.

BUT before you continue, think about what we’ve discussed so far and decide whether travel hacking is right for you.

Put another way:

Can you responsibly handle the power that comes with having multiple credit cards?

- Do you spend within your means?

- Do you pay your bills on time and in full?

If these answers are no, you’ll be better off saving money little by little to pay for the vacation you want to take.

Earning miles and points for travel rewards isn’t worth damaging your credit score over.

You should also consider these two points carefully.

- If you’re applying for a loan, like for a mortgage, a car, or college tuition, finish this process first before applying for any credit cards.

- If your credit score is under 700, it will be difficult for you to be approved for travel rewards credit cards. Work to bring up your credit score before applying for any. A tool like Experian Boost can help you increase your FICO® score. It’s a completely free tool with no credit card required that can instantly improve your credit score by factoring your mobile phone and utility bills.

- If either of the two points above applies to you, earn miles and points with shopping portals and dining programs in the meanwhile.

So, what questions do you have about travel rewards credit cards?

Like this post? Please share it on social media using the share buttons below.