Disclosure: The Globetrotting Teacher may receive commission from card issuers. Some or all of the card offers that appear on the The Globetrotting Teacher are from advertisers & may impact how & where cards appear on the site. The Globetrotting Teacher does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Miles and points beginners often ask which travel rewards credit cards for beginners are the best. It’s understandable.

First, there are so many travel rewards credit cards available. Second, many people believe credit card myths which make thinking about where to start even more stressful!

This post will highlight:

- the Chase 5/24 rule,

- which Chase credit cards you should start out with, and,

- the timing to consider as you get started with travel rewards.

Before continuing, though, it’s important to understand, you’ll need a credit score of 700+ to qualify for most travel rewards credit cards. Many credit cards offer customers the ability to check their credit score. If you don’t have one that does, use a service like Experian to find out your FICO credit score for just $1.

And lastly, responsible miles and points enthusiasts always pay off their credit card balances in full at the end of the month. If you have trouble doing so, travel hacking isn’t the right hobby for you.

Travel Rewards Credit Cards for Beginners:

The First 5 to Get + a Strategy

I’ve outlined a step-by-step strategy for beginners getting started with travel rewards credit cards. Keep in mind this strategy is ideal for most people in order to maximize Chase’s travel rewards given their 5/24 rule.

But, no matter what, you should always do what’s best for your travel goals and finances.

What is the Chase 5/24 rule and Why is It so Important to Know?

The major banks have application rules and Chase, by far, has the most restrictive.

If you’ve been approved for 5 or more credit cards in the last 24 months from any bank, Chase will deny your application even if you have a stellar credit score. Travel hackers affectionately refer to this rule as 5/24.

Combine this with the fact that Chase offers some of the best travel rewards credit cards, in terms of welcome bonuses and long-term spending value, and you can see the problem this rule can unknowingly pose to miles and points beginners.

Too many credit cards from other banks in the last 24 months likely means being locked out of the Chase Ultimate Rewards travel program until time passes and less than 5 new credit card applications show on your credit score report.

Chase 5/24 Rule: Subject to vs Adding to your Overall Count

As mentioned above, Chase will not approve you for any of their travel rewards credit cards if you’ve gotten 5 or more new credit cards in the last 24 months.

It’s important to understand that all Chase travel rewards cards, including Chase business cards like the card_name are subject to the 5/24 rule.This means Chase will consider and apply this rule to determine if you’re eligible for the card.

However, some credit cards won’t add to your overall 5/24 count.

These include:

- Chase Business Credit Cards, like the Ink Business Preferred, and

- Business Credit Cards from most other banks.

For example, if you’re 4/24 (4 new credit cards from any bank in the last 24 months) and you try for a Chase business card like the Ink Preferred, Chase would apply the 5/24 rule to your application because the card is subject to the 5/24 rule.

You’d be hypothetically approved because you have less than 5 new cards in the last 24 months. After being approved, though, you’d still be seen as 4/24 by Chase because business cards don’t add to your 5/24 count.

Understanding that important rule, let’s move on to an application strategy for you to consider.

Step 1- Choose 1 of the 2 credit cards below.

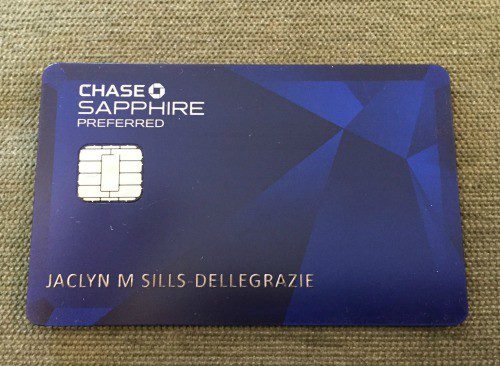

The Chase Sapphire family consists of 2 cards, Sapphire Reserve and Sapphire Preferred. Both of these cards are subject to the 5/24 rule. In addition, there are 2 other Sapphire rules to know.

- Chase allows customers to hold only 1 card in the Sapphire family at a given time.

- You’re eligible for a Sapphire welcome bonus only if it’s been more than 48 months since your last Sapphire bonus.

For this reason, it’s important to compare each Sapphire card’s benefits carefully and choose the card best for you.

card_name

Current Welcome Bonus: Earn 60,000 points after spending $4,000 in the first 3 months from your account opening.

Favorite Card Features:

- $300 travel credit

- 5x on flights booked through the Ultimate Rewards Portal

- 10x hotels and rental cars booked through the Ultimate Rewards Portal

- 10x Lyft rides

- 3x on other travel and dining

- 1x on all other purchases

- Priority Pass Select Membership

- $100 credit for Global Entry or TSA Pre✓

- No foreign exchange fees

- Transfer Ultimate Rewards points to airline and hotel partners like United, Iberia, and Hyatt

- 1.5 cents per point value if you redeem points for travel in the Chase Ultimate Rewards Portal

- Member FDIC

Annual Fee: $550

The premium Chase Sapphire Reserve is made with travelers in mind. More than half of the annual fee can be easily offset with the $300 travel credit.

If you’re someone who would normally spend $300 in a year on travel, then why not do that through the Sapphire Reserve and get the added benefits of lounge access, Global Entry credits, primary car rental coverage, and more?

Chase’s definition of what counts as travel is quite generous. In addition to flights, hotels, cruises, and car rentals, the $300 credit is good for things like highway tolls, taxis, parking expenses, campground fees, and commuter transportation like subways and trains.

The Ultimate Rewards points that you earn with Chase Sapphire Reserve® can be transferred to a variety of airline and hotel partners or used with an added 50% bonus within Chase’s travel portal for a 1.5 cent per point redemption value.

You can read my card review here.

card_name

Current Welcome Bonus: Earn 60,000 points after spending $4,000 in the first 3 months from your account opening. That's $750 when you redeem your points through the Chase Ultimate Rewards portal.

Favorite Card Features:

- $50 annual Ultimate Rewards hotel credit

- 5x on travel booked through the Chase Ultimate Rewards Portal

- 3x on dining (including eligible delivery services)

- 3x on select streaming services & online grocery purchases

- 2x on other travel purchases

- 1x on all other purchases

- No foreign exchange fees

- Transfer Ultimate Rewards points to airline and hotel partners like United, Flying Blue, and Hyatt

- 1.25 cents per point or 25% more value if you redeem points for travel in the Chase Ultimate Rewards Portal

- Get a 10% Anniversary points boost calculated by how much you spent on the card during the year

- Rely on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Complimentary DashPass which comes with no delivery fees and lower service charges on DoorDash orders for a minimum of a year (activate by 12/31/24)

- Member FDIC

Annual Fee: $95

The card_name is a compelling card, stacked with great earning potential and benefits. It’s arguably the best first card for anyone just getting started with points and miles.The annual fee can be offset by more than half with the $50 hotel credit when booking through the Chase Travel Portal, as well as from the Ultimate Rewards points you’ll earn from everyday spending for dining, online grocery purchases, and streaming services.

In addition, Sapphire Preferred has access to the same airline and hotel partners as above with the Sapphire Reserve. The Ultimate Rewards points earned with Sapphire Preferred can be redeemed in the Chase travel portal for1.25 cents per point.

You can read more about Sapphire Preferred here.

Step 2- Choose 1 of the Freedom Cards

On their own, the Freedom cards offer typical cashback rewards and/or the option to book travel solely through Chase’s travel portal at a 1 cent per point value.

However, when paired with a Sapphire or an Ink Business Preferred, the Ultimate Rewards points you earn can be combined with your Sapphire and/or Ink balance and gain access to Chase’s airline and hotel transfer partners.

These transfer partners have the ability to increase the per-point value well beyond the fixed valuation in the Chase Travel Portal.

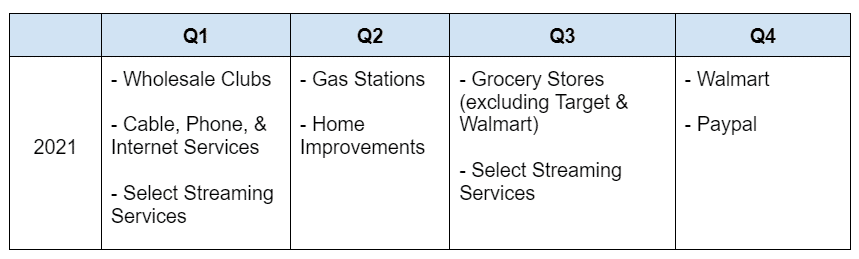

Chase Freedom Flex℠

Current Welcome Bonus: (OFFER EXPIRED. Check with Chase for the most up-to-date offer.) $200 after spending $500 in the first 3 months after opening your account.

Favorite Card Features:

- 5% on rotating bonus categories up to $1,500 each quarter

- 5% on travel booked through the Chase Travel Portal

- 3% on drug store purchases and dining (including delivery and takeout)

- 1% on all other purchases

- Paired with a Sapphire Preferred, Sapphire Reserve, or Ink Preferred, cashback rewards points can be combined to become transferrable Ultimate Rewards points

Annual Fee: $0

With the Chase Freedom Flex℠, you get a great complement to either of the Sapphires. The 5% or 5x the points for every dollar spent that comes with the rotating bonus categories is an easy way to target additional areas of spending.

You can spend up to $1,500 per quarterly bonus to earn 5x for a possible total of 30k additional Ultimate Rewards points each year.

Combine this with the added earnings on drug store purchases, dining, and travel booked through the Chase Travel Portal and you have a no-fee card packed with value.

card_name

Current Welcome Bonus: INTRO OFFER: Earn an extra 1.5% cash back on all your purchases (on up to $20k of spending in the first year) that's worth up to $300 cash

back!

Favorite Card Features:

- With this offer:

- Get 6.5% cash back on travel bought through Chase Ultimate Rewards(R), Chase's travel rewards program where you can redeem rewards for cash back, travel, gift cards & more.

- Earn 4.5% cash back at drugstores and for dining, including takeout and eligible delivery service.

- Get 3% on all other purchases (on up to $20,000 spent in the first year).

- After a year as a cardholder or when $20k is spent, get 5% cash back on Chase travel bought through Ultimate Rewards(R), 3% cash back on drugstore purchases and for dining, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- Get a 0% Intro APR for 15 months from your account opening on purchases and balance transfers; Variable APR of 20.49% - 29.24% thereafter.

- No minimum amount to redeem for cash back. Choose to get a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards don't expire as long as you remain a cardholder.

- Paired with a Sapphire Preferred, Sapphire Reserve, or Ink Preferred, cashback rewards points can be combined to become transferrable Ultimate Rewards points

- Member FDIC

Annual Fee: $0

Chase Freedom Unlimited does not have rotating quarterly bonus categories. Instead, it offers 1.5% or 1.5x the points on all purchases all the time. There is no cap on annual spending or the number of Ultimate Rewards points you can earn.

It’s a great credit card to have for any non-bonused spending in your budget, as well as to take advantage of any dining, drugstore, and Chase Travel Portal purchases.

You can compare both Freedom cards here in this guide.

What Type of Credit Score Do You Need For These Cards?

The Chase Freedoms and the Sapphire Preferred require good to excellent credit scores. If you decide to go for the Sapphire Reserve, you’ll need excellent credit.

If your credit score is low, consider starting first with a Freedom card instead of a Sapphire. By spending responsibly and paying off your bill in full each month, you’ll help your credit score and build a relationship with Chase for future applications.

You can also avoid unnecessary credit card denials. Visit a Chase bank near you and ask a representative about the offers you’re already pre-qualified for and fill out an application in the bank branch.

Step 3- Consider a Chase Business Card.

Beginners often don’t realize they can qualify for business credit cards. Side businesses like selling items on eBay, tutoring, plowing snow, consulting, owning rental properties, and even having a blog can all qualify as businesses.

The key is knowing how to honestly explain your business to the bank. In fact, that’s the most important thing to remember, be honest!

Fill out the application properly and possibly provide the bank with additional information should they request it. You can learn more about if you qualify and how to apply for a business card if you do.

Remember, all of these business cards are subject to the 5/24 rule but won’t add to your overall count. You could/should even consider more than 1 Ink card before any cards mentioned in Steps 4 and 5.

card_name

Current Welcome Bonus: Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months as a cardholder. That's worth $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel(SM)

Favorite Card Features:

- 3x on travel, shipping costs, internet, phone & cable services, and advertising with social media sites and search engines on the first $150k in combined category spending

- No foreign exchange fees

- Transfer Ultimate Rewards points to airline and hotel partners like United, Flying Blue, and Hyatt

1.25 cents per point value (or 25% more value) if you redeem points for travel in the Chase Travel(SM) - Member FDIC

Annual Fee: $95

One of the biggest things to consider initially with the Ink Business Preferred® Credit Card card is the minimum spend needed to reach the welcome bonus. You never want to apply for a new credit card and miss the initial bonus.

In addition to the benefits above, Ink Business Preferred also offers great cell phone protection when you use your card to pay for your phone.

Even better, all the Ultimate Rewards points earned can be combined with other Ultimate Rewards points earned and transferred to Chase’s transfer partners.

card_name

Current Welcome Bonus: Earn $750 after spending $6,000 in the first 3 months from opening your account.

Favorite Card Features:

- 5% on office supply stores and internet, phone & cable services on the first $25k in combined category spending

- 2% on gas stations and dining on up to a combined $25k in spending

- Paired with an Ink Preferred or Sapphire, the $750 welcome bonus becomes 75k Ultimate Rewards points that have access to valuable airline and hotel transfer partners like United, British Airways, Virgin Atlantic, and Hyatt.

- Member FDIC

Annual Fee: $0

Like the Freedom cards, points earned with the card_name have the same fixed 1 cent per point value in the Chase Travel Portal. And on their own, the Ultimate Rewards earned with Ink Cash can’t be transferred to any of Chase’s travel transfer partners. However, all points can be merged with an card_name, card_name, or card_name to have access to Chase’s transfer partnersThe Ink Cash card also comes with collision insurance for business car rentals and purchase protection.

card_name

Current Welcome Bonus: Earn $750 after spending $6,000 in the first 3 months from opening your account.

Favorite Card Features:

- Earn 1.5% on all purchases with no spending cap made for your business

- Paired with an Ink Preferred or Sapphire, the $750 welcome bonus becomes 75k Ultimate Rewards points that have access to valuable airline and hotel transfer partners like United, Flying Blue, Virgin Atlantic, and Hyatt.

- Member FDIC

Annual Fee: $0

Like the Freedom Unlimited, the card_name earns 1.5% or 1.5x Ultimate Rewards points per dollar on all purchases with no annual spending cap.As with the Ink Business Cash, you’ll need to pair this card with the Ink Preferred or a Sapphire to combine your Ultimate Rewards points and transfer them to an airline or hotel partner.

Purchase protection, collision coverage for business car rentals, and extended warranty perks also are included with this card.

Step 4- Choose 1 of the following options.

In addition to credit cards that earn Ultimate Rewards points, Chase also offers co-branded cards with airlines and hotels. Determining which of these cards is right for you in your “First 5” strategy depends on your travel goals.

For example, Southwest credit cards can help you travel more domestically.

But if you’re someone who mostly travels internationally, the Southwest cards may not make the most sense.

Below, you’ll find different credit card options to consider. You choose which seems to be the best combination for your needs.

Option A: Southwest Credit Cards

Southwest Rapid Rewards Points are very useful for booking award flights within the United States, Hawaii, the Caribbean, Mexico, and Central America.

Southwest also offers its fantastic companion pass once you earn 135k Rapid Rewards points in a calendar year. It’s arguably one of the best deals in points and miles because it allows a companion to fly free with you for up to 2 years!

Consider whether the personal and/or business Southwest credit cards are right for your travel goals.

You’d need 1 Southwest personal card and 1 business card to get close to or even reach the amount needed to earn the Southwest Companion Pass. Or, you could also consider 2 Southwest business cards.

There are 3 personal credit cards. These include:

As their names suggest, each one scales upward with its perks and benefits. Each year you renew your card, you’ll get a varying number of Rapid Rewards points (depending on your card) as an anniversary bonus.

Chase also offers 2 Southwest business credit cards. These cards include:

You’ll earn bonus points when you use your card to pay for Southwest flights and target card bonus categories. Both cards also have no foreign exchange fees.

And remember, two bags fly free on Southwest, but the Southwest cards let you check an extra one at no cost.

Option B: United Co-Branded Card & a Co-Branded Hotel Card

If your travel goals include more international travel than domestic, a United miles/hotel points combo will be more useful than Southwest Rapid Rewards points.

Why United over another co-branded airline credit card like British Airways or Aeroplan?

United miles are good for domestic and international travel on United or any of their Star Alliance partners. Even with United ditching its award charts, there are still ways to redeem United miles for a solid value, especially for a multi-city itinerary to Europe.

Additionally, United is one of Chase’s travel partners. You’ll be able to transfer Chase Ultimate Rewards points earned with your Sapphire, Ink Business Preferred, and Freedom (when paired with a Sapphire or the Ink Preferred) directly to United at a 1:1 ratio.

United miles also are more straightforward when it comes time to redeem them. Other airlines’ miles have their value but may not be as obvious until you learn more about maximizing your points and miles with partners.

There are several United credit cards to choose from. They are:

Cardholders get a range of benefits depending on the card. Perks can include United Club passes, priority boarding, a free checked bag, a $100 Global Entry Fee, and exclusive award space seen only by cardholders.

Chase’s co-branded hotel cards include the:

- World of Hyatt Credit Card

- card_name

- Marriott Bonvoy Boundless® Credit Card

- card_name

- card_name

- card_name

Depending on where you travel and your overall travel style, one brand may be better for you than another.

Hyatt offers the most value because of its upscale properties, reasonable award chart, and the ability to transfer Chase Ultimate Rewards points to Hyatt. The downside is Hyatt has a smaller, (albeit growing) geographic footprint than Marriott or IHG.

In fact, Hyatt could quite be the best Ultimate Rewards transfer partner of them all.

And, even though, Marriott and IHG are Chase Ultimate Rewards transfer partners it’s a much better value to earn points with these programs respectively instead of transferring valuable Ultimate Rewards points.

Finally, if you’re just getting started with miles and points, you may not realize Marriott is also its own flexible currency. The program has 40+ airline transfer partners, some of which cannot be accessed through other travel rewards programs, like American and Alaska Airlines.

Timing Matters

By now, I hope you’re thinking about your first 5 travel rewards credit cards from the options above.

However, don’t try for all of them at once! In fact, the steps in this guide could easily play out over 12 months or more!

Not to mention, Chase has become tougher on individuals with too many applications in a short window of time. In some cases, even shutting down their accounts altogether!

- First and foremost, start slowly. Be smart about each credit card decision. Keep your travel rewards goal in mind.

- Consider the minimum spend on each credit card and what you can responsibly handle. There’s no point in opening a new card and not getting the welcome bonus.

Technically, Chase will typically only approve you for 2 credit card applications every 30 days. Each time you try for a new credit card, banks do a hard pull of your credit score. New credit cards can come with a temporary dip in your credit score. So, think carefully about your timing and never apply for a new credit card if you’re also planning to apply for a mortgage or loan.

Personally, I recommend opening no more than 1 Chase card every 30 days and typically wait a bit longer than this before applying for another one myself.

Put it all together: What does this strategy look like?

A beginning credit card strategy could look like this. But remember, don’t compare yourself to others, and just do what makes sense for you.

FIRST

Choose the Chase Sapphire and Chase Freedom that are right for you. Personally, I like the card_name for anyone starting out and the superpower of earning 5x with Chase Freedom Flex℠.Wait at least 30 days between applications.

SECOND

After at least a month+ has passed since your last application and, preferably after you’ve met any minimum spends on the previous cards, check out the card_name and/or the card_name or card_name.Remember, Ink Preferred can stand on its own with access to Chase’s transfer partners. However, Ink Cash and Ink Unlimited need the Ink Preferred or a Sapphire to gain the same transfer privileges.

THIRD

If you’re interested in a Southwest Companion Pass or even just earning Rapid Rewards points for your travel goals, look at a Southwest business card like the card_name.FOURTH

After at least a month (& preferably more!) has passed and you have the Southwest Rapid Rewards Premier Business credit card, consider a personal card, like the card_name.OR…

Skip the Southwest cards in the third and fourth steps and consider the co-branded airline and co-branded hotel card option.

If you’re not on the Southwest path and went for the Ink Business Preferred, look at the card_name or card_name.Follow this up with a co-branded hotel card choice that fits your travel goals. Personally, the World Of Hyatt Credit Card would be my choice for a first hotel card. But it needs to make sense for you.

If you’ve got a trip in mind, look to see which hotels are at that destination.

Bottom Line

No matter which options you choose, you should carefully consider your first 5 Chase credit cards. This is a critical key to success when starting out in order to maximize your miles and points earnings. Don’t lock yourself out of earning these welcome bonuses and the travel rewards they continue to bring with everyday spending.

As always, go at the pace that’s comfortable for you. Have a plan for the travel rewards you’re earning. Don’t take on more than you can handle financially and organizationally. And, be sure to pay off your bills in full and on time each month.

So, which travel rewards credit cards for beginners are you interested in?

Like this post? Please share it on social media using the share buttons below.