Disclosure: The Globetrotting Teacher may receive commission from card issuers. Some or all of the card offers that appear on the The Globetrotting Teacher are from advertisers & may impact how & where cards appear on the site. The Globetrotting Teacher does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Are you an average American with average monthly bills and expenses who wants to travel more?

Do you feel like you just don’t know how to make your travel dreams come true and pay your bills at the same time?

No, this is not another travel blog post telling you to give up your morning coffee to travel more. I’ve written about the reasons why I travel hack and why you should, too.

I’m a teacher who regularly uses miles and points to travel the globe. I don’t travel regularly for work. Nor do I have a corporate card where I can rack up miles and points on my company’s dime.

This means, my everyday spending is the key to my long-term miles and points earning success.

In this post, we’ll look at the average American household spending habits and how to make your travel dreams come true with the money you already spend.

How to Make your Travel Dreams Come True with Money You Already Spend

There’s no denying travel rewards credit card sign-up bonuses boost loyalty program accounts quickly.

But, it’s possible to effectively earn and redeem miles and points for travel in a strategic way to continue earning well past the initial welcome bonus.

Everyday spending is the marathon runner that’ll continually grow your miles and points balances steadily over time with the money you already spend.

What’s better, you can do it with what an average American regularly spends each year on their bills and expenses.

What is Everyday Spending?

Before looking at actual numbers and award travel examples, let’s make sure it’s crystal clear what I mean by everyday spending.

Everyday spending simply refers to all your bills and regular expenses.

How can everyday spending get me closer to my travel goals?

Make every possible dollar spent work harder and bring some value back in return.

For me, the value comes in the form of credit card, airline, and hotel points and miles. Others focus on cashback rewards or saving for college tuition.

Either way, the principle is the same. Spend smarter, not more. And, certainly, don’t send your hard-earned money out into the world without getting something back!

So, what exactly does this look like in everyday life?

This means, put your debit card away (cash, too!) and use travel rewards credit cards to pay for everything possible.

Of course, you must be a financially responsible person who doesn’t overspend and who pays their bills on time.

This includes paying off whatever amount you put on your credit card(s) in full each month.

Otherwise, the interest you spend on credit card debt will take value away from any miles or points (or cashback) you’re earning.

What if I don’t have a travel rewards credit card?

If you’re financially responsible, I do recommend getting a rewards credit card that will help you earn a return value on your spending.

Based on bank rules, there are important strategies to know about the first cards to get.

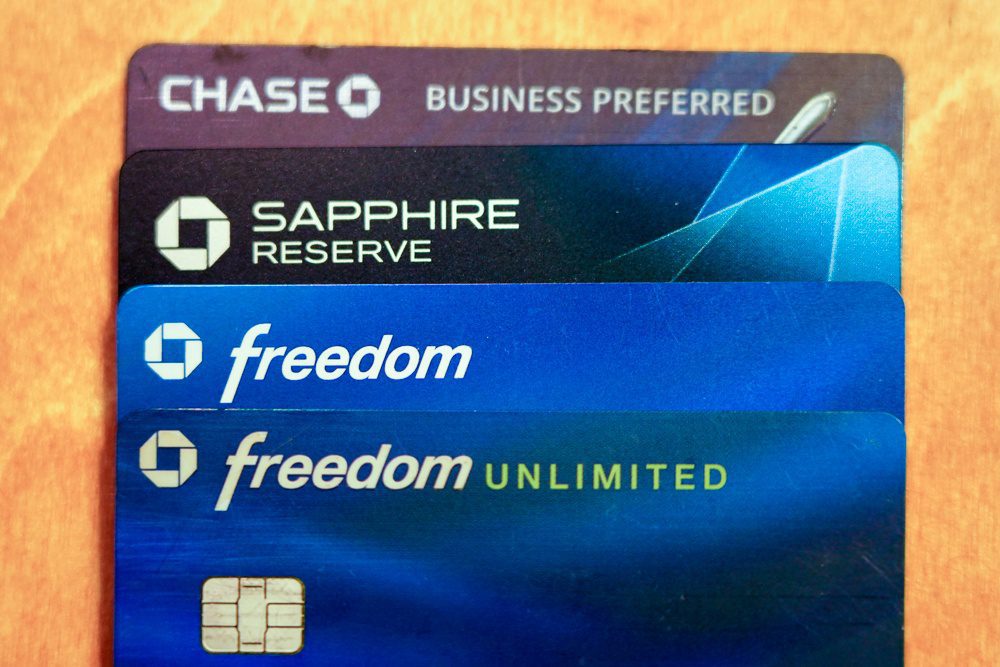

My recommendation for a first travel rewards credit card is, begin with the Chase Sapphire Preferred.

You’ll earn valuable Ultimate Rewards points which can eventually be transferred to any of Chase’s 11 airline or hotel partners.

The Freedom Unlimited is also a great card if you want the option of earning cash back rewards and flexible points that can be transferred to airline and hotel partners when the Unlimited is paired with a Chase Sapphire Preferred or Sapphire Reserve or a business credit card like the Chase Ink Preferred.

Another thing I love about the Freedom Unlimited card is it earns 1.5% on all purchases, making it a great everyday spend card.

You can also earn miles and points for travel without flying by using dining programs and shopping portals.

To learn more about how to maximize your everyday spending and travel rewards credit cards, enroll in my FREE Travel Hacking Basics Course.

It teaches all the basics you need to know about earning points and miles and how to get started with redeeming them for award flights and hotel nights.

Average American Monthly Bills and Expenses

Not every bill or expense can be paid by credit card, but many can.

So to start, you need to change your motto when it comes to your everyday spending.

Think of your everyday bills and expenses in terms of miles and points.

For the sake of using real numbers, I’ve used the Consumer Expenditures Report for 2018 (latest available) put together by the U.S. Bureau of Labor Statistics.

The data shows everything from average American expenses to income to population demographics. Luckily for both of us, I don’t teach statistics so I promise I’m not going to bore you with all the details. 😉

Instead, I’m going to highlight a few of the expenses from the report that can be paid for with a travel rewards credit card.

According to the report, here’s what you, an average American, might spend in a year in these categories.

- Groceries: $4,464

- Eating Out: $3,459

- Utilities, Fuels, & Public Services: $4,049 (includes cell phone charges, cable & internet)

- Household Operations, Supplies, Furnishings, & Equipment: $4,294 (things like cleaning supplies, smoke alarms, lawn supplies, carpets, moving fees, dishes, and closet organization tools.)

- Apparel & Services: $1,866

- Gas, Motor Oil, Other Vehicle Expenses, Public Transportation: $9,761

- Healthcare: $4,968

Just these few categories add up to more than $30k a year!

Of course, these numbers are national averages and your own everyday bills and expenses are unique to you.

But, what do you notice from the list that looks high or low for your monthly bills and expenses?

For me living in NYC, my public transportation expenses are more than my vehicle expenses. Fortunately, my healthcare costs are less, but my eating out costs are higher.

Now, if you’re thinking of everyday bills and expenses as miles and points, that’s more than 30k you can earn each year just for paying the bills and buying the food, clothes, haircuts, etc, you were already planning to buy anyways.

More importantly, if these expenses and bills would normally be paid for with a debit card or directly debited from your bank account, there’s no reason you wouldn’t be able to pay off the same amount on a credit card in full at the end of each month.

The BIG difference is with a travel rewards credit card you’re earning a return on your money, but with a debit card, your money leaves forever without so much as a wave goodbye.

What about expenses that are missing?

Your biggest monthly expenses, mortgage or rent, and car payments are not included on the list. These bills typically can only be paid with a credit card via a third-party bill pay service like Plastiq.

These services charge fees, though, which are better to avoid unless you’re trying to meet a credit card minimum spend.

ProTip: Double-check that your rent can’t be paid with a credit card. Some apartment buildings and landlords utilize a payment platform that will accept rent payments via credit card.

How can I get even more from my everyday spending?

The best part is those 30k miles or points can actually be much more if you make the most of bonus categories, dining and shopping rewards, and promotions.

The above calculations assume you’ll only earn 1x point per $1 spent.

However, travel rewards credit cards like the Chase Sapphire Preferred earn 2x the points on travel and dining. Travel even includes things like public transportation, highway tolls, and parking fees.

Freedom Unlimited earns 1.5% on all purchases no matter what the welcome offer happens to be to sweeten the deal.

In fact, most travel rewards credit cards offer permanent or promotional bonus categories on everything from groceries to drug store purchases and gas.

Bonus earn rates can be as high as 10x when bonus categories and promotions are stacked.

This means, your $30k in average spend for the categories above can earn much more than that when you’re strategic about your credit cards and spending.

So, let’s look at the $3,459 the average American spends on eating out each year. If that person paid with the Sapphire Preferred, she’d earn 6,918 Ultimate Rewards points.

If even half of that spending was at dining program restaurants with an additional 3x-5x earn rate, she could potentially earn an additional 5,100-8,600 miles or points.

Similarly, the $1,866 on apparel and services could earn well more than the typical 1x the points per $1 if you use shopping portals.

A $100 pair of Nike sneakers bought in the store would earn just 100 points or within a shopping portal at an earn rate of 8x the points for 800 points! Which sounds better to you?

What do all these miles and points get you?

That’s the elephant in the room, right? What can these points get me???

In order to show some award travel possibilities, I’m going to make the assumption you have and use the Sapphire Preferred and the Freedom Unlimited for all of your everyday spending.

At the end of a year, you’d have earned the Ultimate Rewards points from the welcome bonuses. And, going by these average American expense numbers, you’d have earned at least 30k points, depending on your expenses.

It’s also safe to add in another 10-20k points depending on how well you maximized bonus categories, dining rewards, and shopping portals.

Using these modest calculations, you’d have up and over 100k Ultimate Rewards points to redeem for award travel.

Not too shabby for signing up for 2 travel rewards credit cards and using them for all your everyday spending.

You could:

- Transfer 60-70k points to United for a round-trip flight from the U.S. to Europe. Take advantage of their Excursionist Perk and open-jaws to visit 3 European cities, like Amsterdam, Paris, and Rome for the same price as visiting just 1 city!

- Transfer 35k points to Air France/KLM’s Flying Blue program to fly to Northern South America. Depart from a city like Chicago and head to Quito, Ecuador to explore the country’s history and natural wonders.

- Make use of transfer partner, British Airways, to fly to Hawaii from the west coast. For just 26k points roundtrip per person, you could (depending on availability) fly a family of 4 to Hawaii.

Of course, these are just a few of the many possibilities. Even the biggest miles and points skeptic must admit the simplicity of using just a couple of travel rewards credit cards and regular everyday spending to earn award travel.

The point is, there are no more excuses. You can travel for much less by making your everyday spending work harder and realize your travel dreams.

How will you maximize your everyday spending?

Like this post? Please share it on social media using the share buttons below!

Learn all the Travel Hacking Basics you need to know by enrolling in my FREE course!