Disclosure: The Globetrotting Teacher may receive commission from card issuers. Some or all of the card offers that appear on the The Globetrotting Teacher are from advertisers & may impact how & where cards appear on the site. The Globetrotting Teacher does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How do you keep maximizing your miles and points earnings once you meet the minimum spend on your travel rewards credit card and earn the welcome bonus?

Many travel rewards credit cards come with bonus spending categories. With them, you’ll earn more than 1x point per dollar when you use the credit card for purchases in that specific category.

In order to leverage the full potential of credit card bonus categories, you have to keep track of which card to use when and where.

The Ultimate Guide to Travel Hacking:

Credit Card Bonus Categories and Beyond!

There’s a running joke in my house where my husband often looks helplessly into his wallet not sure what credit card to use for which purchases.

He knows many of the cards have bonus categories and is lucky he has a travel-rewards obsessed wife who knows.

Oh, he absolutely loves when I’m shouting, “Use Sapphire Reserve!” as he runs in to pickup our Friday night pizza.

Step One- Know Your Credit Card Bonus Categories.

1. As a travel hacking beginner, you likely have just a few travel rewards credit cards.

Knowing which card to use for specific types of spending should be clear and straightforward. The key is remembering when you’re out there spending!

Typical credit card bonus categories include spending on:

- groceries

- restaurants

- travel

- gas

- streaming services

- office supplies

- and telecommunications (cable, the internet, phone, etc.).

The more you maximize your credit card bonus categories, the more miles and points you’ll earn in a shorter period of time.

The credit card bonus categories were probably part of the reason you applied for the card in the first place. It may also be what makes paying the annual fee on a credit card not only worth it but also a no-brainer.

One consideration is knowing your spending patterns.

Someone who drives long distances for work should absolutely have a travel rewards credit card with a gas bonus category like one of the Hilton Surpass or Blue Cash Preferred offered by Amex or the Citi Premier.

Keep your travel goal in mind, though.

Having 100k Hilton points won’t necessarily be immediately valuable if your upcoming destinations don’t have Hilton properties nearby.

Do your research to know which type of miles and points you need for your travel goal.

The bottom line is you absolutely need to know and keep track of which credit card to use for which type of spending.

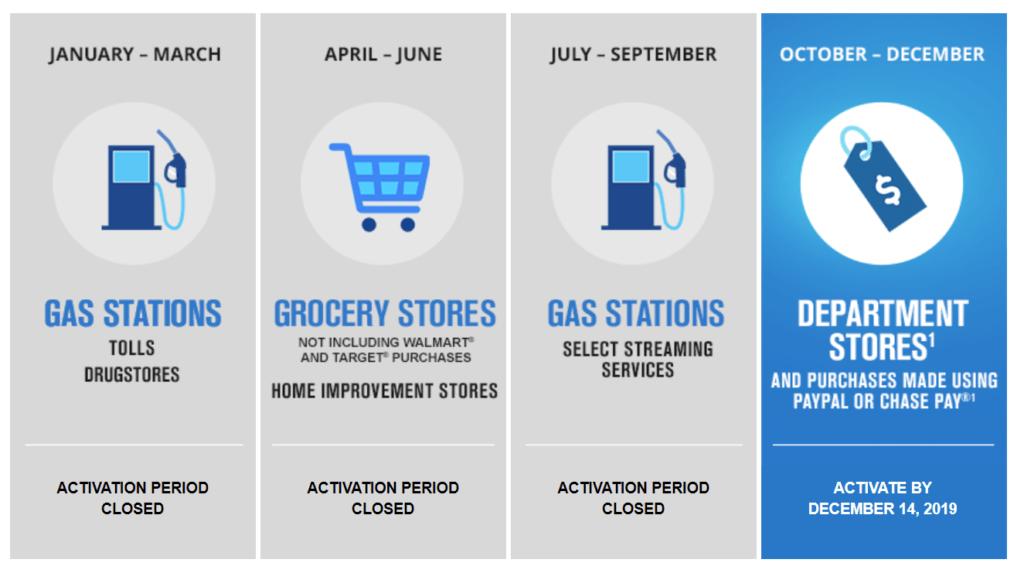

2. Some cards, like the Chase Freedom Flex have rotating bonus categories that change each quarter.

With these cards, you’ll earn 5x the points or cashback on whatever the bonus categories are for that quarter up to $1,500 in spending.

Before the new quarter begins, you need to activate the bonus category in order to qualify for the 5x the points or cashback. Both cards have no annual fee.

Chase Freedom Flex, in particular, partners perfectly with other Ultimate Rewards earning credit cards like the Sapphire Reserve, Sapphire Preferred, and Business Ink cards, allowing all points earned with Freedom to be transferred to one of the other cards.

Afterward, the total points can be transferred to Chase’s travel partners.

3. One last option to consider is building a travel rewards wallet that includes a card for non-bonused spending.

You’ll inevitably have bills and purchases that don’t align with any bonus category. However, some cards offer more than 1x per dollar for all purchases.

Cards like Chase Freedom Unlimited, the Blue Business Plus Card from American Express, and the Capital One Venture X Rewards Credit Card all earn more than 1x per dollar for all purchases.

Additionally, they all earn flexible rewards currency and combine well with other cards in their respective travel rewards eco-systems.

Stop and Think:

- What credit cards do you have?

- What bonus categories do they offer?

Make a note for yourself and stick it in your wallet or save it on your phone so you can refer to it when you’re making purchases.

As you continue with points and miles, the goal is to have cards to cover all your categories of spend so you’re always earning more than 1x for every dollar spent.

Step Two- Think Outside the Box

Knowing which card to use to maximize bonus categories is just the first step.

The more you learn and the more creatively you think, the more likely it is you’ll find ways to double and triple dip on points.

Consider a few examples.

Chase Freedom Flex typically includes one quarter per year with a grocery spending category. All money spent up to $1,500 in grocery stores would earn 5x the points.

If you were to max out the bonus categories each quarter that would be an extra 7.5k points multiplied by 4 quarters for a total of 30k points annually.

Not bad for a no annual fee card!

But, what if you don’t spend $1,500 on groceries in a quarter?

1. Instead, make use of the gift card kiosks often found in grocery stores. They often sell gift cards from Visa to Starbucks to Home Depot and everything in between.

Think about upcoming purchases, gifts you plan to give, even grocery gift cards for yourself to use in the future, to make the most of the bonus category.

If you buy the gift cards with your Freedom Flex card, it will register as a grocery purchase and you’ll earn 5x the points.

If you have the Ink Cash, the same applies as above, except at office supply stores. I even purchase Amazon gift cards at office supply stores and load them into my Amazon account to always earn 5x the points when I shop there.

2. Double-dip on your miles and points earnings by using shopping portals.

The miles and points earned from a shopping portal are in addition to your credit card’s bonus categories.

If you buy an item through a shopping portal that also happens to be a bonus category for one of your credit cards, you’ll earn miles and points from your credit card and through the shopping portal.

Office Supply stores sell visa gift cards, sometimes at a discount. Staples even allows you to buy gift cards online.

Purchase the highest-value gift card with a points-earning credit card, preferably one that has an office supply bonus category. Then, use the visa gift card(s) to buy through a shopping portal to earn, even more, miles and points.

In particular with Visa gift cards, start slowly. Even if your intention is to use them for your bills and expenses, they sometimes attract the wrong kind of attention from banks.

3. American Express Offers is another way to think more creatively about your spending and earning.

If you have an American Express account, go to the bottom of your home page and look for “Amex Offers & Benefits.” Click the “Load More” option to see all available offers.

Look for deals at places you would normally shop or at merchants where you plan to shop.

Also, though, look for discounted gift cards or purchases for stores like Lowes, Home Depot, or Staples that also have gift card kiosks. An offer might look like this, “Get $15 off when you spend $100 at Home Depot.”

If you find an Amex offer that works for you, simply click “add to card” and then use that credit card to make the purchase at that merchant before the offer expires.

But, how can this be lucrative for miles and points earning?!

Consider the Home Depot offer from above. If you go to Home Depot and buy a Visa gift card from their gift card kiosk and pay with the American Express card you added the offer to, you’ll get a $100 gift card for $85.

- You’ll earn American Express points from the purchase.

- You’ll have made a profit because the activation fee for a visa gift card is usually $6.95 and you saved $15.

- Now, use that visa gift card to shop through a shopping portal. You’ll earn whatever the earn rate is for the store you choose.

ProTip: Just be sure to read the terms for each shopping portal. Some of the bank portals, like Chase and Capital One only let you earn points for shopping when you pay with one of their credit cards.

One note about Amex Offers…occasionally there are offers to increase the earn rate when you use your card at particular stores.

For example, earn 2x the points when you shop at Target or Amazon. This allows for a double dip if you use your American Express to shop at Target through a shopping portal.

It’s also a good way to earn extra at Amazon if you don’t have another way to increase your earn rate.

4. Last but not least, be on the lookout for time-sensitive promotions sent via email or snail mail.

For example, my Citi American Airlines Platinum Select credit card upped its earn rate for specific bonus categories for a limited time. It made sense to use that card for these purchases during this time.

If I hadn’t checked my mail, I would’ve missed it!

Give it a try.

- Which credit card can you use to buy a gift card to do some portal shopping?

- Check out the Amex Offers for your card to see what’s currently offered.

Step Three- Every Little Bit Helps!

I’m always looking for ways to maximize my spending and you should, too. In fact, I have no loyalty to any stores. I follow the best deals to earn as many miles and points and other rewards as possible.

Here are a few ideas to consider in addition to the ideas above.

- Take a look at rewards websites and apps like Ibotta and Dosh. They allow you to earn cashback rewards that stack with your credit card bonus categories and shopping portals.

- Remember shopping portals for travel bookings, too! Hotels like Marriott and IHG can earn extra airline miles and because you still book through the hotel itself, you’re able to earn hotel points and accrue nights to earn status.

- Speaking of booking travel, use shopping portals to earn when booking on sites like Expedia and Travelocity. Not only will you earn rewards from the portal, log in to your account, for example, with Expedia to also earn Expedia points.

- Lastly, look for shopping portal promotions. Back-to-school and the holiday season often come with miles and points earning bonuses for meeting spending tiers. This is in addition to any rewards earned from your credit card, an Amex offer, Ibotta, etc.

Credit Card bonus categories are the key to long-term miles and points earning. With some effort, your purchases can yield huge returns on your spending in the form of travel rewards.

What questions do you have about credit card bonus categories?

Like this post? Please share it on social media using the share buttons below!